The holidays are a time for being thankful for family, friends, and the recent slump in oil prices. Obviously lower oil prices mean Americans save more on gasoline, but oil prices affect many aspects of the energy and financial world. The recent happenings in the oil market have been a game of chess and the US currently has the upper hand. Today we look to discuss why oil prices have dropped, where they could be heading and what it all means for the energy industry.

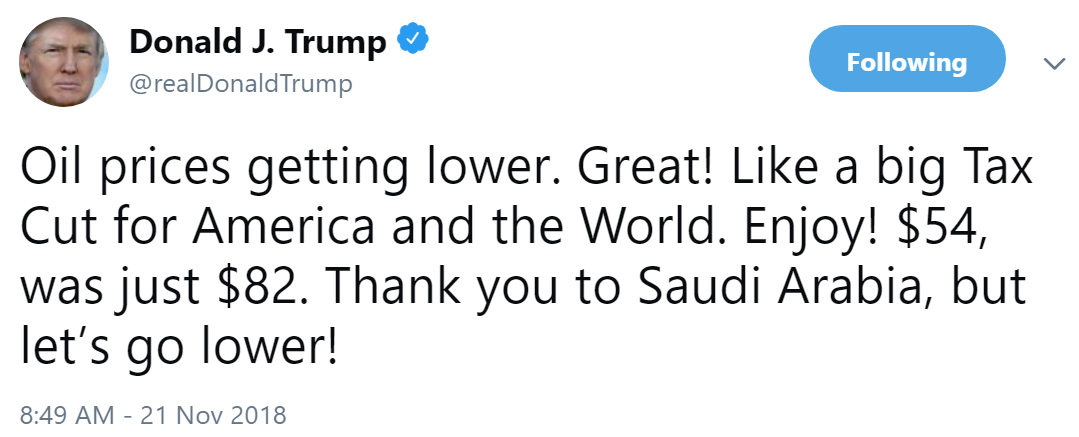

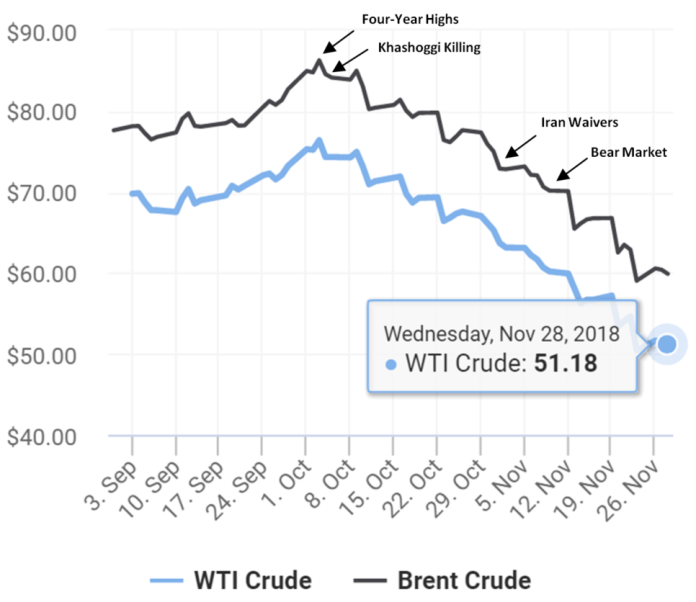

The endless oil match has been set and the pieces assembled. The supply/demand fundamental is the King of the chess board. All actions in the match are meant to protect or expose this piece, and the price of oil is determined off of it. A mere two months ago we were discussing how tight the oil market could get, after an expected loss in production. This quickly changed due to the Queen piece of the board, geopolitical issues. Geopolitical issues can move in any direction at any time, and can test all other fundamentals in the oil market. We last discussed geopolitical issues in our Check Back Soon blog series in July, but have lately seen a flurry of news involving two of the Rooks on the board, President Trump and Saudi Arabian Crown Prince Mohammad Bin Salman. After the suspected ordered murder of journalist Jamal Khashoggi, tensions have been high between the U.S. and the Kingdom. President Trump has not indicated any retribution towards the King, likely in an attempt to suppress oil prices. All the while, the U.S. has been issuing waivers to countries to use Iranian oil, which many previously believed would be cut off by sanctions. While there are many other back story Pawns at play here, the end result has been an increase in supply on the market versus what was expected. In the days following the Khashoggi killing on October 2nd, oil has seen one of its’ quickest slumps ever, with WTI down 32% from over $72/bbl to $52/bbl (not to be confused with Trump mixing Brent and WTI in his tweet). At one point there were 12 straight days of falling prices. The match has turned in favor of President Trump and Americans seeking low oil prices.

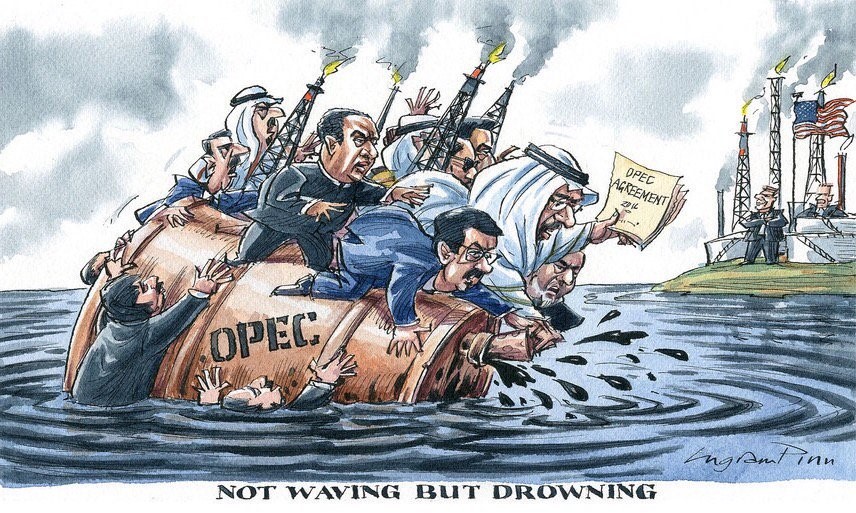

Two months ago, analysts were saying that oil could go to $100/bbl. Now there are analysts saying that we could fall back in to the $40 range. Factors affecting the outlook of oil prices include: Federal Reserve interest rate hikes (which strengthen the dollar, lowering the relative price of oil), a continued trade war with China (which hurts consumption), and lastly whether or not OPEC will announce a new round of production cuts. All of these factors are set to be decided on in the next few weeks. If we see the bearish outcomes of all these factors, prices could fall further. A bullish correction is also possible given the volatile nature of these fundamentals. It will also be important to watch how American producers will fare with profitability in the long run with prices falling. Aside from oil, we have not seen a significant impact on the natural gas market. The Permian region is still increasing its production of oil, and associated natural gas is currently near capacity, with additional oil and gas pipelines coming online in 2019. This growth will help ensure the US maintains the power to control energy markets.

It is no secret that the price of oil has a huge impact on the world economy. However it is often understated how much of a rippling impact oil can have on many fronts in the energy market. It is not often that we discuss the oil market, but the recent 30% slump in prices was worthy of discussion today. The future impacts of this move are still speculative, but regardless we will continue to monitor the situation, and report on any implications this significant move may have for our clients.

Confidential: Choice Energy Services Retail, LP.