By: Chris Amstutz

Whoever started the idea that 2021 was going to be a more simple, normal year should be run out of town. *Insert more 2021 vs. 2020 meme’s here*. New COVID strains, new politicians, and continued social uneasiness is making it feel like the 14th month of 2020. Add the fact that complex energy market regulations are back in the headlines and the chaos only grows. We have seen many stories floating around regarding the recent Executive Orders passed by the new Biden Administration affecting energy markets. As with all changes of the guard, it is out with the old and in with the new. We are here to dispel some of the fake news, and lay out what the facts are pointing to at this time.

Despite what your great uncle says on Facebook, Choice! Energy Management takes no stance of morality or political affiliation on any of the issues discussed, and merely hopes to shine a light on events that influence energy market prices.

Executive Order (EO) 13990: Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis

This EO was signed on the first day in office (Jan. 20) and most notably takes aim at cancelling the Keystone XL Pipeline. This notorious pipeline was set to transport 800,000 barrels of oil per day from Alberta, Canada to Nebraska. This infrastructure project is a lightning rod of symbolism, as it has now spanned 3 administrations worth of attention. Its cancellation is seen as a large blow to the Canadian oil industry, as well as the Gulf coast petrochemical industry. It is seen as a big win for environmentalists and Native Americans whose land is near the pipeline’s path.

EO 13990 also repeals more than 100 EO’s from the Trump Administration on climate and energy infrastructure policies. Many of the EO’s from the Trump administration were in place to repeal notable regulatory orders from the Obama administration (Cross State Air Pollution & Clean Power Plan ). The orders now being reinstated will impose limits and increased regulation on pipeline construction, pollution, drilling, emission standards, and power generation fuel sources.

Executive Order(EO) 14008: Tackling the Climate Crisis at Home and Abroad.

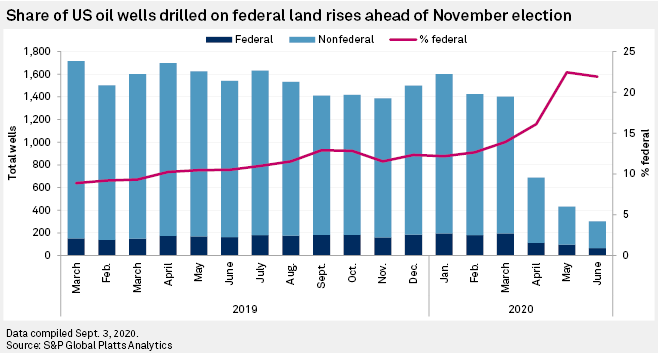

This Executive Order is the beefiest of them all on the energy front, and entails many climate and energy policies promised on the campaign trail. The order most notably directs the Secretary of the Interior to impose a 90-day moratorium on new oil and natural gas leases on public lands/waters (though in a way this does break Biden’s other campaign promise to not ban fracking). A few highlights of the implications of the drilling ban are:

- The area most affected by the ban is the Permian region of Southeastern New Mexico.

- Many of the companies operating in this region have “stockpiled” leases and the largest producers have up to 3 years to continue operating as usual.

- Small drilling companies and ironically New Mexico tax revenues (a state that voted 55% for Biden & whose Albuquerque Congresswoman will be the next Secretary of the Interior) will be the most negatively affected.

- Decreases in oil and gas supply will be minimal in the short run, but could fall in 2-3 years (just in time for a new set of election promises) if the policy is continued.

The winds of change were not limited to the ban on drilling leases. Other policies laid out in EO 14008 include:

- The establishment of a National Climate Task Force across 21 Federal Agencies, as well appointing John Kerry as Special Presidential Envoy for the Climate.

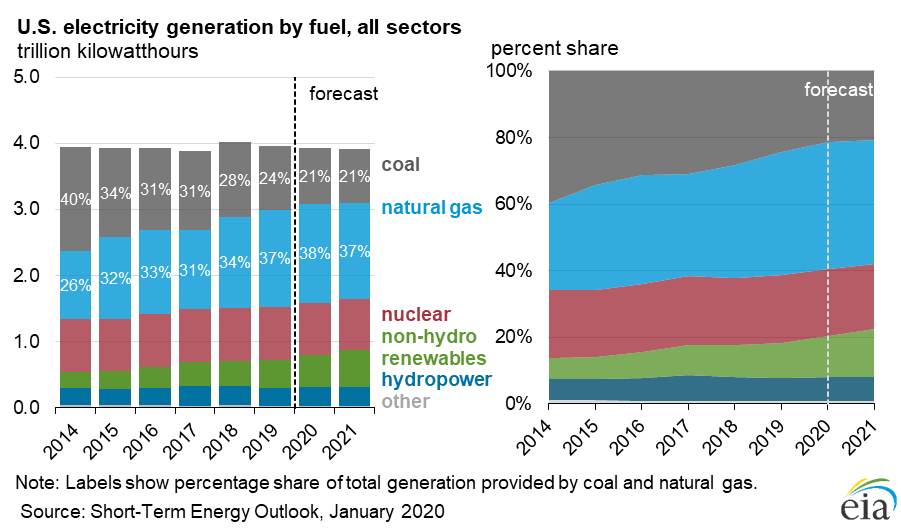

- The official development of emission reduction targets. The campaign promise was to set a path to cut all greenhouse gas emissions from the nation’s electric sector by 2035 and to make the country carbon-neutral by 2050.

- A commitment to clean infrastructure projects, which will likely be manifested in significant grants and continued subsidies for renewable energy. This will have a continued influence on the power industry.

Executive Action: Commitment to the Paris Climate Accord

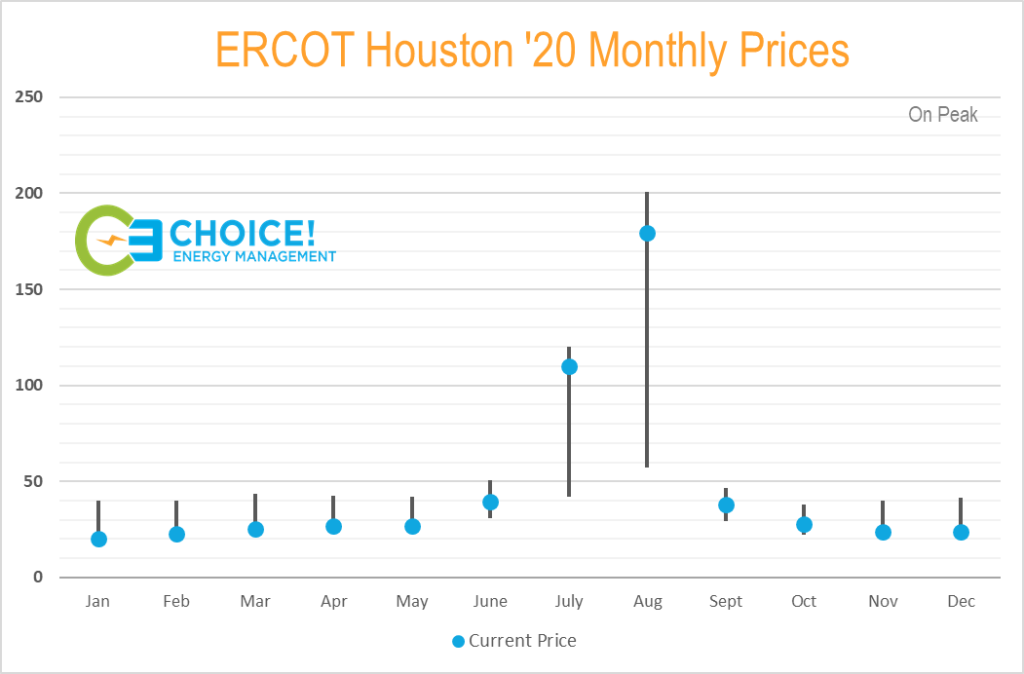

On his first day in office, President Biden also signed the action recommitting the U.S. to the Paris Climate Accord. While this action does carry a symbolic weight, it does not directly impact the energy markets at this time. The implications will be felt later, with further action taken on the previously discussed EO 14008 (the beefy EO). The extent to which the U.S. commits to lowering carbon emissions will impact all sectors of the energy markets. Natural gas and oil may see increased demand in the next 10 years, but could begin to lose demand past that. Coal usage will likely continue the slow decline. All carbon commodity usage forecasts depend upon on the penetration of renewable energy technologies in the market. Power prices will also be affected but those implications are largely regional and include nuances such as battery storage and intermittency/grid reliability issues.

All in all, the recent Executive Orders have been symbolic of the Biden Administration fulfilling campaign promises. You can view all of President Biden’s Executive Orders here. While there may not be immediate implications for the energy markets from these EO’s, the symbolically anti-carbon stance of this administration will likely have price implications in the next 2-3 years. Pipeline infrastructure, changing power market dynamics, and federal subsidies and taxes are all long term influences. Like any complex market, change takes time, and the implications will show in the future. We may not be able to see the exact path forward at this time, but we do have an idea of the direction. After all, it’s not like anyone accurately predicted the events of 2020 anyway.

Cover Image Illustration by Jack Taylor, Bloomberg Green