The recent pricing spikes in California serve as an interesting case study in the energy community. A series of events have aligned in California to give the CAISO grid and SoCal gas system their biggest test in the last ten plus years. It certainly feels like Murphy’s law is at work in Southern California, and this has left analysts wondering if there could be anything else that could go wrong (hint: there always is). California is now entering a time of energy purgatory. The previously optimistic market analysts have suffered financially and now must atone for their mistakes. So what has made the situation so extreme? Will the conditions continue? And what are the ongoing trends affecting California energy markets? While these questions fall partially upon the agnostic gods of energy, the ultimate implication is whether California will return to the paradise of low prices, or if it will fall further toward a metaphorically and slightly-literal hellscape.

Natural Gas

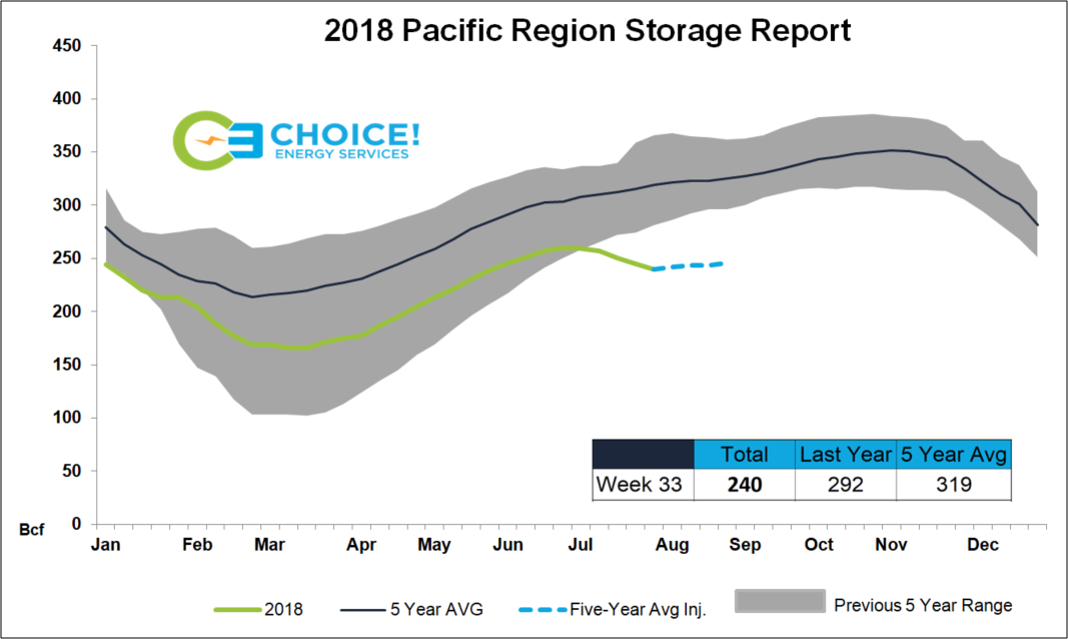

On July 24th, the SoCal Citygate daily average settled at $39.53/MMBtu, adding something else to the list of things for Californians to complain to their city councils about. To give perspective, SoCal Citygate averaged $3.20/MMBtu in June-July of 2017, and NYMEX was trading at $2.73/MMBtu that same day. The record high sustained heat led to July being the warmest on record in California. The heat is surely the top culprit for increased daily prices, but this doesn’t nearly sum up the SoCal Gas story. When we look at the entirety of the gas transportation system, we see pipeline capacity restrictions of about 50% in the North and South zones entering the region. This indefinite, limited pipeline capacity becomes especially concerning when you factor in the gas storage situation in not only Southern California but the Pacific region as a whole. The Aliso Canyon storage facility in Los Angeles has just been approved to increase its’ storage capacity to 40% of total capacity, after its ongoing troubles with a leak. Supply constraints and low storage means we could begin to see serious pricing issues in the winter, when Southern California burns the most gas. The long term fundamentals have pushed futures prices higher with the SoCal Border Calendar 2019 strip now at NYMEX minus (-) $0.14/MMBtu, up $0.51 since late April. However, this is still down off of the high on 8/6 when the ’19 strip actually settled at NYMEX plus (+) $0.025. The Calendar 2020 strip is up 20 cents in the same time period. With all of this news, we are setting up for a situation where a moderate fall and warm winter can be the only savior for the region.

Power

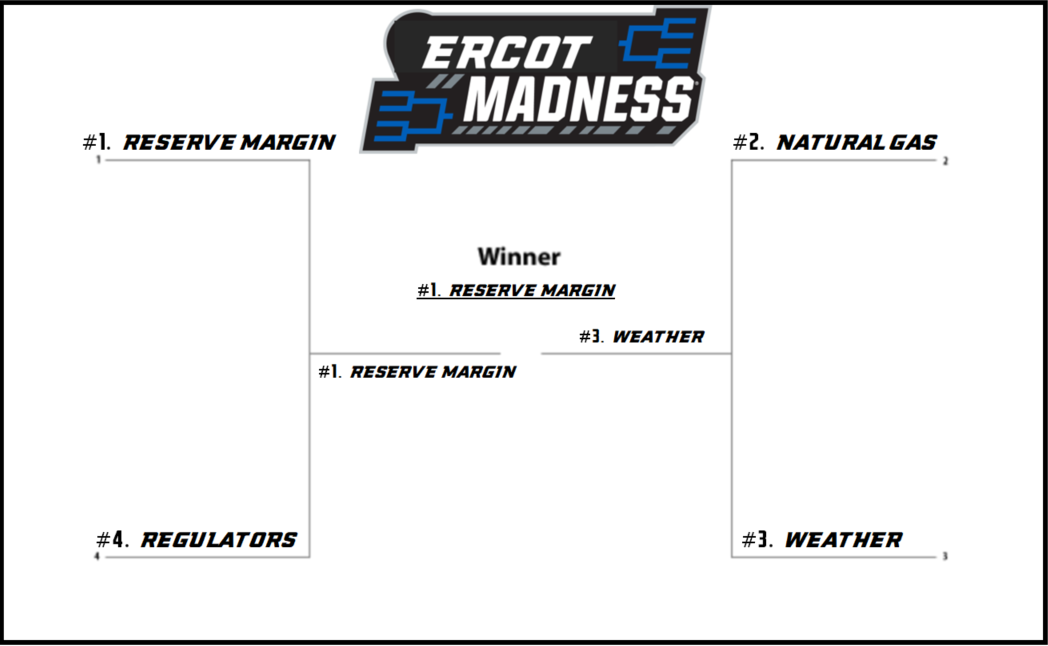

On July 24th we saw the daily SP-15 hub price hit an all time high of $377/MW. This represented the peak of pricing during the extended “heat dome” weather period. The extreme heat brought a curtailment notice from SoCal gas to generators in CAISO. This was then passed on in a ‘flex alert’ curtailment notice (not a SoCal body building term) to power consumers. The fundamentals affecting the power market have not been favorable this summer. Certainly the issues with gas supply discussed above play in to this, but we have also seen hydroelectric outputs 30% lower than last year. California has also retired 6 GW of reliable coal/gas fired generation in the last 4 years. This means that solar and wind power have had to take the place of this lost generation, and these resources are inherently more volatile due to their dependence on weather. BUT WAIT THERE’S MORE… we have also seen a highly active year for wildfires (25% above five-year average) in California (reference the “slightly literal hellscape” quote above). Wildfires impact the transmission of electricity into regions, causing increased congestion on lines, even on days when there is adequate generation to meet demand. The futures market has reacted, with the SP-15 Calendar 2019 strip now at $42/MW, up $10 from February. The 2020 strip is up $5 in the same period.

So is the implication that California energy prices are damned for eternity? Obviously not, but the recent run up sits fresh on the mind of traders and analysts. The California market has always had an air of uncertainty to it, but until recently there has not been a pricing premium in the futures markets. This recent panic has burned (no pun intended) a lot of people who had been profiting on rolling the dice month to month during normal market conditions. The threat of what we have seen this year has been known for almost a year and those that diligently locked in their prices beforehand will now profit. While this may be the current trend, there are already rumors about the California government intervening (surprise, surprise) to keep things like this from happening again, which could potentially push prices lower. Regardless, the gods of energy prices always favor the informed, and Choice Energy Services is here to help keep their light shining favorably (financially) upon your business.

Confidential: Choice Energy Services Retail, LP.