By: Chris Amstutz

The winter storm of the century in the energy capital of the world has frozen all preconceived notions of the Electric “Reliability” Council of Texas. As the snow melts and the plumbing repairs begin, the analysts at Choice! Energy Management find solace in aiding Texans through these difficult times. With any natural disaster, people want answers and to know how their interests will be protected in the future. This has given way to the blame game and many myths about the Texas power market. To help address these questions we look back to the long running, scientific TV series MythBusters. The causes of the ERCOT disaster are innumerable and it is with an open mind that we dissect the situation.

Myth (noun): A widely held belief not factually proven; an exaggerated or idealized conception.

Myth #1: “ERCOT should have been able to prevent the power outages with the 7 day notice they had of the impending weather event.”

Answer: Busted

This disaster has shown the weaknesses of the ERCOT grid, especially in the winter. Generation assets in Texas did not have the infrastructure upgrades to prevent malfunction during the cold, known as winterization, and this is likely the main reason for failure last week. Winterization was an expense spared by generators since a deep freeze does not occur often, helping Texans to enjoy lower power prices. Like the Titanic heading for the Iceberg (see the MythBusters confirm that Jack could’ve survived with Rose here), the 7 day forecast was not enough time to prepare the grid. ERCOT operates under the assumption of a ten-year normal winter (which will certainly change now), and this event was likely a one-hundred-year event.

Myth #2: “One single energy generation source (renewable, fossil fuel, or nuclear) was to blame for the blackouts.”

Answer: Busted

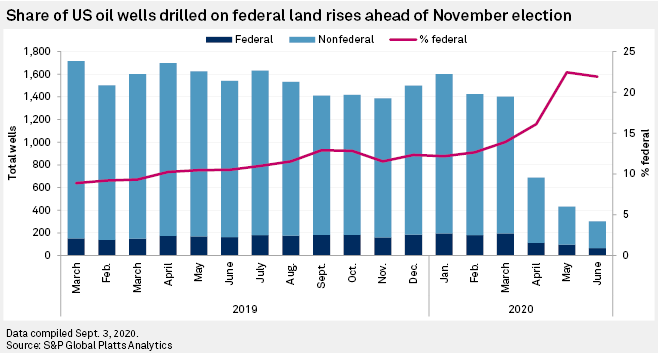

This popular political talking point (everything is political these days), has been thrown around a lot. To this we point to the graphic below. Yes, the wind turbines were frozen and yes, natural gas and coal did have the largest absolute decreases in generation available, but pointing to half the truth is not the truth. In all reality, the frozen precipitation had huge impacts on every generation source. From pre-freeze levels, it is estimated that natural gas lost 15-20 Gigawatts (GW’s) of generation, not including the 15 GW’s that were offline for seasonal maintenance. Wind Generation fell from 5-10 GW’s pre-freeze to 1-2 GW’s during. Coal lost 6 GW’s during the freeze, and even the incredibly steady nuclear baseload lost 25% (1.3 GW’s) due to the fear of insufficient water supplies. Future ERCOT conversations will now involve adequate winterization, and a repricing of all assets not protected from winter weather and sufficient reliability.

Myth #3: “This was a black swan weather event so the chances that prices get this crazy again are tiny.”

Answer: Busted

A black swan event is defined as something “unpredictable” but this weather event has occurred before in ERCOT. The Christmas cold of 1989 was the most similar event to this, with colder absolute temperatures but not lasting as long. The grid also came close to blackouts in the 2011 cold event. When you also look at demand side issues, like the fact that Texas has added 1.5 million homes since 2011 (the most of any state by 600k homes), and 62% of these homes require electricity for heating, it compounds the issue. We have discussed power market volatility in our past blogs here, here, and here. With less reliable, non-winterized generation on the grid, ERCOT will remain susceptible to price spikes, and higher futures prices will be needed to steady the market.

Myth #4: “Forces outside of Texas wanted the blackouts to occur, and sabotaged Texans in some form.”

Answer: Busted

While not a widespread myth we have seen this claim thrown around. There is no reason to believe at this time that willful negligence or any other human induced action in the short time leading up to and during the event caused the power outages. From fake snow conspiracies (see here), to rumors of Department of Energy sabotages, there has not been any evidence of at this time. It is true that several members of the ERCOT board (including the now former chairman) reside out of state, but as of today all of these members have resigned due to criticism.

The last two weeks have certainly been difficult. Consumers are very much justified in demanding that reliability of the grid is prioritized to prevent an event like this from happening again. However, everyone is quick to forget the enormous amount of savings the ERCOT market structure has provided Texas in past years. The critics of the free-market ERCOT system are now louder than ever, and the future of this system is unknown. Opportunity will favor the informed, as the implications shake out from this event. The analysts at Choice! Energy Management take pride in helping our clients prepare, and look forward to helping more Texans navigate this ever-changing energy world.