By: Matthew Mattingly

123

Everyone seems to have strong opinions on the high energy prices impacting our country (and the rest of the world). Record high prices at the pump, coinciding with historically high prices for all fossil fuels have more people talking about energy supply and demand than I can ever remember. I’ve worked in the industry for over 15 years, but now can’t escape the conversation at a cookout, grocery store, or even my kid’s baseball games. I’ve heard it all; from blaming it all on Biden, to “Big Oil” price gauging (remember they make more money than God himself). Unfortunately, all of this conversation has allowed a lot of incorrect information and misleading data to be spread. The intel is often provided by extremely intelligent people. However, with countless market fundamentals to follow and technical trading patterns to evaluate, it’s difficult for those outside the industry to get the full picture of the energy landscape. Today we will discuss and respond to some of the bad energy takes from Twitter we have recently seen by two sports radio hosts from opposite sides of the political aisle.

123

Twitter Name/Handle, Example 1: Matt Jones (@kysportsradio)

Background: Best known as sports radio host and founder of Kentucky Sports Radio. Matt Jones is unlike the customary sports talk jock. His credentials include: being a graduate from Duke University School of Law, authoring a NY Times Best Seller, Mitch, Please!, and an interest in running for US Senate against Mitch McConnell. I personally follow Matt Jones on Twitter because of my love of University of Kentucky athletics and other daily evaluations living in my home state of Kentucky.

Matt Jones’ Tweet: “But I don’t think there is anything our government can do about it (high gasoline prices). We are totally dependent on Foreign Oil.”

Unless you count Mexico and Canada as “foreign oil”, the U.S. is not totally dependent. The U.S. is the largest oil producer in the world and the gap widens when you include all petroleum products (propane, ethane, gasoline, natural gas, etc). The U.S. gained that title in 2018, and oil production peaked in 2019 at 12.25 million barrels per day. While the U.S. does receive crude oil imports, 72% of it comes from North American countries. In the context of talking about Russia and OPEC for our government’s energy policy, we are not dependent upon their oil. Taking it one step further, reducing regulations and bureaucracy in the U.S. would bring more drilling & refineries that would lessen our ties to global prices. There absolutely is something our government could have done and still can do to prevent high energy prices.

123

Matt Jones’ Tweet: “Most individual consumption (oil) come from overseas. We save most of the domestic (oil) for industrial needs.”

This tweet appears to be contradictory. The crude oil market consists of numerous grades of crude oil that vary by weight and sulfur content. Crude with lower sulfur is referred to as sweet, while higher sulfur content is considered sour. The U.S. oil reserves typically produces light-sweet crude oil, which can go to any refinery, and is used mostly for gasoline. While sour crudes (imported from Canada, Russia, and others) produce heavier distillate products, such as diesel and jet fuel, which would be used more for industrial needs. There has not been a refinery built in the U.S. since the 1970’s and many of these refineries are built to take in sour crude. However, the categories on how we can use this oil are not as defined as what the tweet leads readers to believe.

123

Matt Jones’ Tweet : “The same amount of oil is being produced as the Trump era. That’s not the reason that prices have gone up.”

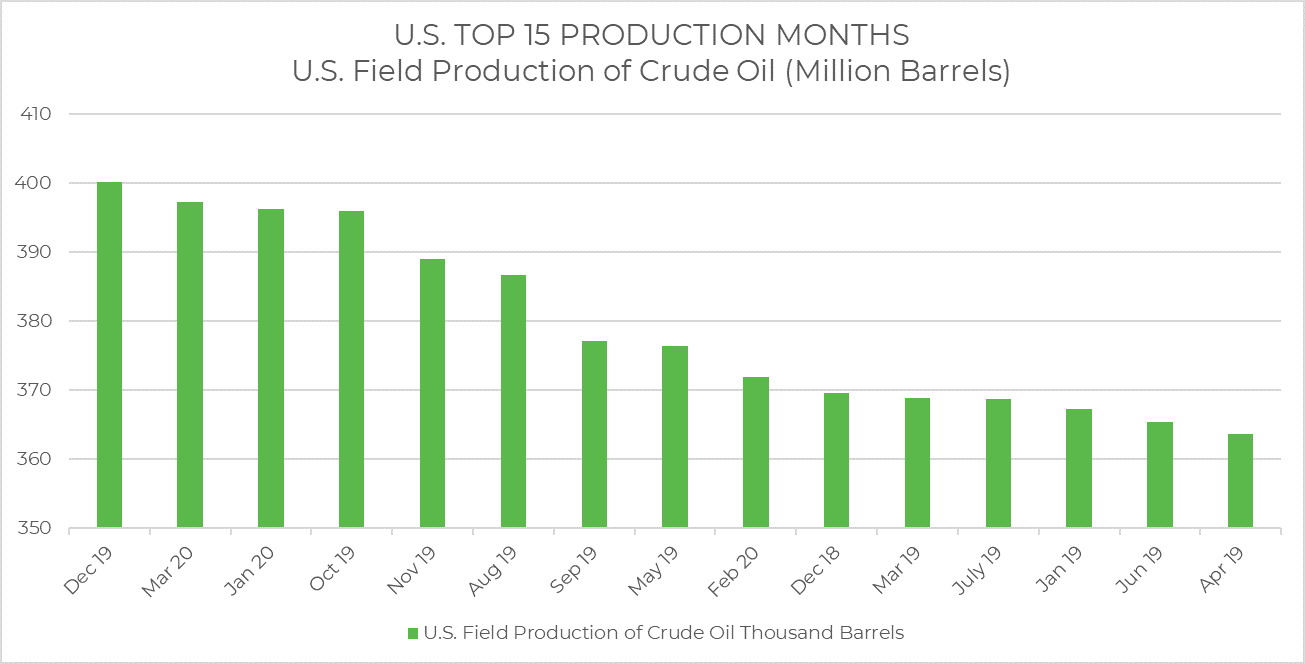

This discussion point is seen a lot, but this is a half-truth. Yes, the U.S. is currently producing as much oil as the final year of Trump’s presidency, but that was during the peak of the pandemic, when demand plummeted and producers shut down wells. The United States’ top 10 oil producing months all occurred during Trump’s presidency as shown in the graph below, peaking in December 2019 at 400,000,000 barrels for the month. The additional 35+ million barrels per month would greatly impact today’s oil market.

123

Twitter Name/Handle, Example 2: Clay Travis (@ClayTravis)

Background: Clay Travis is another lawyer turned radio host, although that might be his only similarities to Matt Jones. Clay received a law degree from Vanderbilt University, but quickly moved to a career in sports with a radio show and the founding of Outkick the Coverage. Currently, Clay is a political commentator on The Clay Travis and Buck Sexton Show, a conservative talk show that replaced Rush Limbaugh. His book, Dixieland Delight, is a must read for SEC football fans like myself, although his love for the low down, dirty Tennessee Volunteers is not his most redeeming trait.

Clay Travis’ Tweet: “Gas has officially passed $5 gallon, an all-time high that acts as a default tax to the poorest Americans, and prices show no signs of coming days any time soon. Joe Biden is the worst president in modern American history, maybe ever.”

Many Democrats simply blame Putin for the rise in oil prices, which is not accurate. Likewise, conservatives like Clay Travis like to incorrectly place ALL of the oil price impacts on President Biden. This was recently discussed by Chris Amstutz in his blog called Shoot Me Straight: Is Biden Wrecking Energy Markets, which discussed the numerous market fundamentals and events that have caused the strong increase in energy prices. As Chris pointed out in the blog entry:

“The truth is, oil, natural gas, and electricity prices began rising in the summer of 2021 to now (up over 100% year over year), due to chronic underinvestment in the energy industry. COVID-19 lockdowns destroyed demand for hydrocarbons, leading to some of the biggest financial losses in the history of American petroleum. The White House now claims that these same companies are gouging Americans, ignoring the need for producers to show a financial return to investors who also lost heavily in 2020-2021. This, coupled with policies that have inhibited domestic pipeline growth and drilling, has added to the global energy shortages we see today.”

Clay Travis Tweet : “Last night’s @seanhannity hit with @GeraldoRivera debating Biden’s plan for high gas prices. Enjoy:

Video: 4:54 Mark…Sean Hannity “He (Biden) was handed energy independence…”

The term “energy independence” is used often, and is something that every U.S. presidential candidate has promised for the last 50 years (as well as stating that this is most important election of my lifetime 😊). However, the term is sort of a misnomer in that the U.S. does not have the infrastructure in place to halt imports completely from other countries and act “independent”. Pipelines, refineries, and economic/political policy have led to our current situation. The blame of high energy prices cannot and should not ever fully fall on a sitting President, due to decades of planning and building in this industry. The U.S. is a “net exporter” of petroleum, but this simply means the value of petroleum we export exceeds the value of what we import. Estimates are that the U.S. uses roughly 18.1 million oil equivalent barrels/day of petroleum, and we produced 18.4 million. How and where these barrels get used, and what part of the world they come from is a much deeper rabbit hole that cannot be condensed into a sports talk show or energy market blog.

123

Conclusion:

As these examples clearly show, two well-educated people have a hard time of getting all the facts straight when discussing energy fundamentals. It’s nearly impossible for anyone outside the industry to keep up with countless, evolving fundamentals that aren’t limited to: storage, weather, rig counts, geopolitics, frac spreads, and U.S. vs. global demand. This is exactly how GETCHOICE! assists our clients. Through market calls, white papers, and market presentations our Risk Management team ensures our clients have the market intelligence to navigate the energy landscape and make educated purchasing decisions. Contact us or your GETCHOICE! Client Advisor to find out more details about our Strategic Procurement and Risk Management services. As for Matt Jones and Clay Travis, I don’t want to be the guy that tells them to “stick to sports” but I sure wouldn’t recommend taking their energy advice.