By: Chris Amstutz

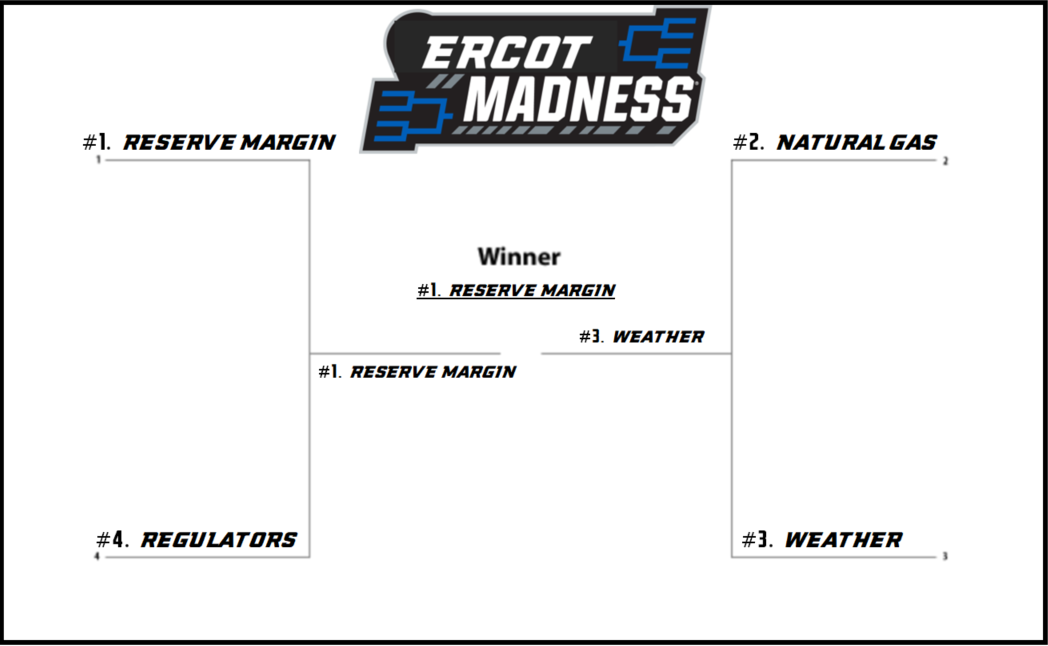

It’s that wild time of the year when work productivity tanks as people across America secretly watch their favorite college basketball team compete for glory in the NCAA Tournament. This sacred month for sports fans will be a roller coaster of expectations and emotions, just like this summer will be in the Texas power market. Price volatility has returned for the Electric Reliability Council of Texas (ERCOT). This summer represents uncharted waters for the ERCOT markets and will have implications affecting future summer pricing in Texas. Just as every NCAA Tournament has a unique cast of teams, this years’ Texas power market has a unique set of factors that are lending themselves to the madness. Let’s meet the teams vying for the right to call themselves the #1 price setting input:

#1 Seed: Power Reserve Margin

Team Bio: The difference between the expected peak power demand and total generation capacity (supply)

Resume: The recommended reserve margin is 13.75% but has fallen to 9.3% this year, strengthening its impact as a price influencer. The retirement of 4.2 gigawatts of coal-fired power announced in 2017 and delayed completion of natural gas and wind power projects has allowed for increased concern.

Intangibles: Has the ability to make traders worry, without factoring in any other price influencers.

#2 Seed: Natural Gas

Team Bio: The NYMEX natural gas market price

Resume: The ERCOT market has traditionally been highly correlated to the NYMEX. The r-squared (direct correlation) between ERCOT Houston and NYMEX natural gas has been as high as 96% for a 90 day trading period. Natural gas prices have been falling which should lower ERCOT pricing.

Intangibles: An easy market indicator to watch. Natural gas pricing panics can influence the ERCOT market quickly.

#3 Seed: Weather

Team Bio: Drought conditions and short-term weather

Resume: The team that shows up to the tournament with the most potential to influence price, but could just as easily not show up at all. Texas summers are notoriously hot and cooling demand puts a huge strain on the ERCOT grid. Early drought conditions are fair and meteorologists are currently not concerned with long range summer forecasts.

Intangibles: The weather is a factor that can either become a huge problem during the tournament (summer), or it can quickly relax pricing tension. The weather is the main influence for short term price volatility.

#4 Seed: Regulators

Team Bio: The Public Utilities Commission of Texas (PUC)

Resume: Intense debate between PUC members has arisen about what could/should happen this summer. These appointed officials are debating whether upward pricing spikes this summer balance the good of incentivizing utility investment with the bad of higher consumer prices. Their laws carry heavy market influence, but consensus seems to be that the market should be left alone heading in to the summer.

Intangibles: The ability to suggest laws regarding power prices can increase power pricing volatility on just talk alone

Results:

As you can see from the tournament bracket above, Choice Energy Services believes that the reserve margin will be the top influence on ERCOT prices this summer. Sure we picked “the #1 seed favorite” and while that may not always be the right move for your NCAA bracket, this is a clear choice. Prices have remained elevated in ERCOT since the announcement of coal generation retirements in October and fears have worsened since with the delay of wind/gas generation projects. The “regulators” in the PUC in Texas can do very little at this point in the year to try to help the 2018 ERCOT pricing situation, and all signs are pointing to a laissez-faire attitude from the committee. We have seen NYMEX natural gas prices fall in the last few months with the national influence of increased supply from the Marcellus/Utica region. Historically, this should have negatively affected ERCOT prices, but instead prices have risen. We still expect natural gas (and its falling futures prices) to have a long term bearish impact on ERCOT prices but it won’t be for this summer at least. The weather is a tough influencer to analyze. It could certainly have a huge influence on price this summer but we are not seeing clear enough signs yet. Texas just came off a historically normal winter and had near normal amounts of rainfall, despite contradicting La Niña conditions. We will get a much better picture of this summers’ weather the closer we get to summer, but there is too much volatility risk either way to try to hedge the weathers’ influence. As witnessed with the NCAA Tournament every year, picking winners and losers in a bracket is never easy. You can gather all the information and trends, like the analysts at Choice Energy Services, or you can pick teams based on their school mascot. Either way, you can rest easy during this fun time of year knowing we have your best energy interests at heart.

(Monmouth University bench circa 2016)