Certainly by now our consistent blog readers are picking up on the theme of relating random pop-culture topics to energy markets, and maybe to your delightful chagrin, this blog will be no different. Today we will continue discussing our latest series on oil market volatility and how Permian production growth fits in to the puzzle. It is well documented that the oil market goes through cycles and this seemingly endless circle has wide reaching effects for other energy markets. What better way to describe the cyclical nature of oil markets, than with a comparison to the classic American cinema trilogy Back to the Future. The repetitively witty script is based on the premise that humans don’t really change, just their time era and setting. In the recent months the market has again become favorable for another timeless American cycle: Oil drilling in the West Texas Permian basin. No DeLorean needed, as we frame the past and present situation before getting Back to (discussing) the Future outlook for the world’s hottest oil play.

BACK IT UP

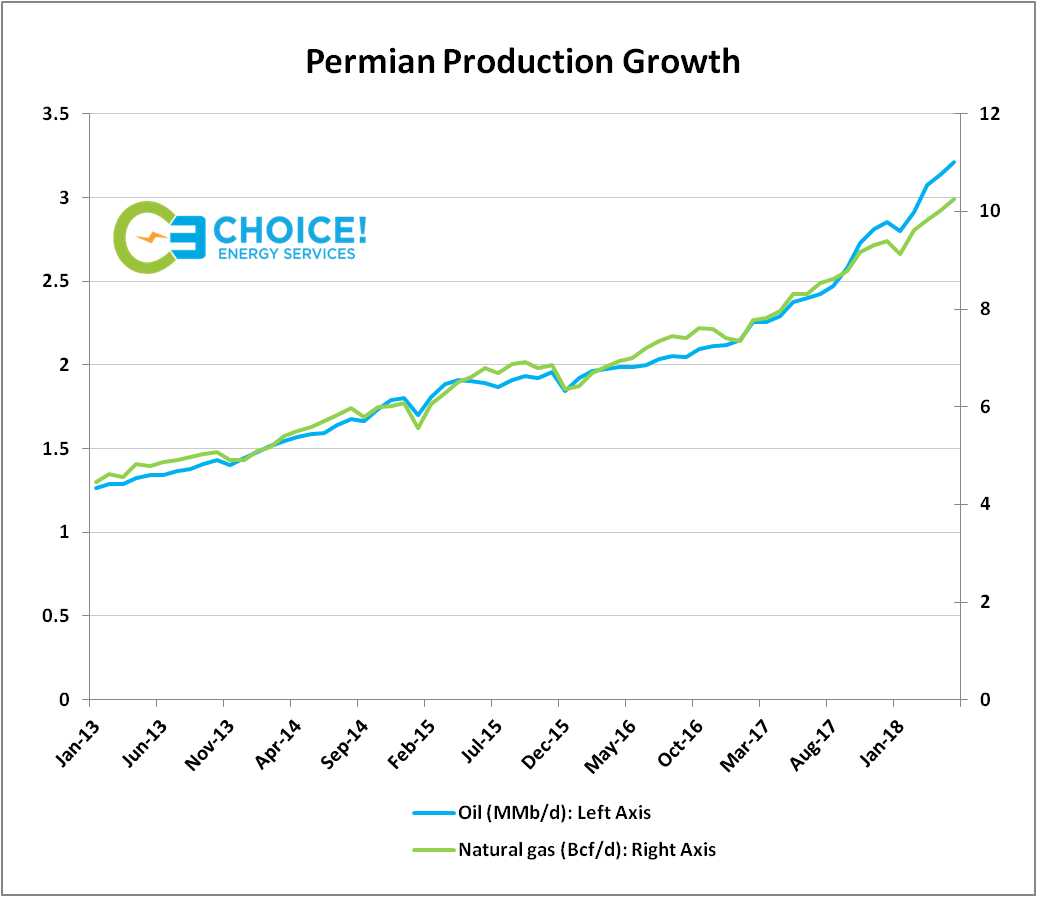

As discussed previously, the recent run up in Oil prices to the current mark of $75/bbl for Brent has caused increased attention and production in the Permian basin. Current output in the Permian is at 3.2 million barrels/day and the total output for the United States is expected to hit 11 million barrels/day by the end of 2018. This level of oil production has not been seen since the 1970’s to mid 1980’s (Back to the Future came out in theatres in 1985, coincidence… I think not). While many of the fundamentals have changed from that time period, the overarching theme of supply and demand affecting price and production are still what feed the cyclical oil markets today. Some analysts project production from the Permian to nearly double (~5 million b/d) in the coming years, which would make it the top producing basin in the world. This outlook has been made possible by a growing global demand for oil and a price level that supports American producers. The caveat to all of this positive news is that West Texas is experiencing intense growing pains. Pipelines out of the region for oil and natural gas have reached capacity and other methods of transportation must be explored. Regional demand has not grown fast enough and oil and gas is trading at a deep discount in West Texas. On April 23rd Waha hub gas traded at NYMEX (-) $1.40/MMBtu (half price) and the Midland oil hub to Cushing oil hub price differential is currently at a $9 discount. Can the region overcome its shortfalls in time before the next cyclical movement? Only Doc Brown and Choice Energy Services are worthy of a guess.

TO THE FUTURE

As long as the flying cars (and trains) that we were supposed to have by 2015 still use petroleum, the Permian can remain fruitful. Global demand for oil has topped 100 million b/d and is expected to grow every year by 1 million barrels/day. The real question is how fast the region will be able to overcome the growing pains of transportation. The June issue of our Bulls and Bears report gave a more in depth analysis on the timeline of pipelines set to relieve the region. While producers have to wait at least 18 months for these new gas and oil pipelines to come online, shipping by rail and truck will account for most of the incremental takeaway capacity. It is estimated that an additional 40 thousand b/d could be transported by truck, and an additional 100 thousand b/d could be transported by rail. This would still not be enough takeaway capacity, with the Permian averaging an increase of 70 thousand b/d, every month. Logistics aside, the region will be facing an oversupply situation and some analysts believe that the Midland oil hub to Cushing oil hub price differential could reach $20. This would certainly be a signal for production to slow, if global prices don’t send the signal before then. How Permian producers react and overcome this near term situation will affect oil market prices for years to come.

TIMELESS

The miraculous production growth in the Permian shale region has numerous implications for the oil markets, as well as other energy markets. The ability for American producers to export oil and influence its’ price on a global level carries tremendous geopolitical power. Additional natural gas recovered as an oil drilling by-product (associated gas), will continue to grow supply levels and keep domestic natural gas pricing depressed. The potentially positive influences from production growth in the Permian are numerous at this stage in the oil market cycle. So without the aid of a time machine, the analysts at Choice Energy Services will continue to monitor the fine details to better manage the risk of our clients.

Confidential: Choice Energy Services Retail, LP.