By: Chris Amstutz

Businesses across the country are taking notice of the rapidly changing power generation mix. Is it simply due to the sight of wind and solar farms popping up along the highway? No, rather it is due to something more vital: their bottom line. From California, to Texas, to the Northeast, the impacts of an increase in power generation from renewable sources and a decline in coal-fired power are being felt. What lies on the river ahead? Recent news and pricing movements across the U.S. are showing signs of a straining grid, primed for increased volatility. Volatility presents opportunity in the energy industry and Choice Energy Management is working to remove the blindfold and safely guide your business to a stream of savings (a more enjoyable experience than re-watching Netflix’s “Birdbox” movie). Our first blog post of the roaring 20’s turns the rudder against the stream to dissect the current path for regional power market structures.

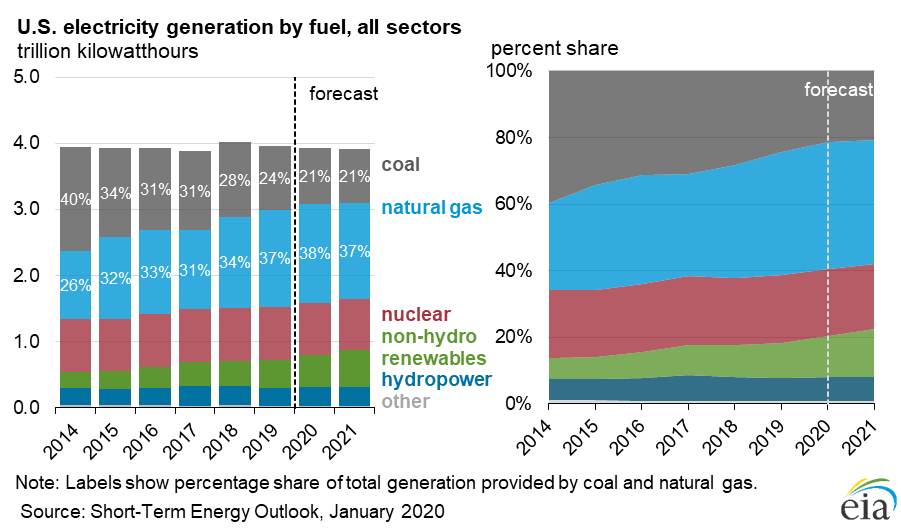

Nationally, we have seen a huge shift in the generation mix since 2014. While the chart above gives the breakout in terms of percentage change for each source of electricity, it does not fully tell the story for what is happening in power markets across the United States. The introduction of intermittent electricity assets to the grid has posed new concerns and challenges that need to be addressed. More plainly speaking, when the wind doesn’t blow and the sun doesn’t shine, how will the electricity grid adapt to keep up with the power demands of end users. Without diverging down the deep, winding stream on the physics and technical nuances of power markets, here are the regions we are monitoring more closely for volatility in 2020:

CAISO: The push towards a Renewable Portfolio Standard for California of 50% by 2030 continues. The state legislature has remained hostile towards fossil fuel and nuclear generation assets. Many believe that the state government is challenging the grid too hard and too fast. The three main utilities (PG&E, SoCal Edison and SDG&E) are all pushing for rate hikes stemming from wildfire liabilities and the increased regional cost of natural gas. This market has already seen tremendous volatility, but tensions have calmed for now.

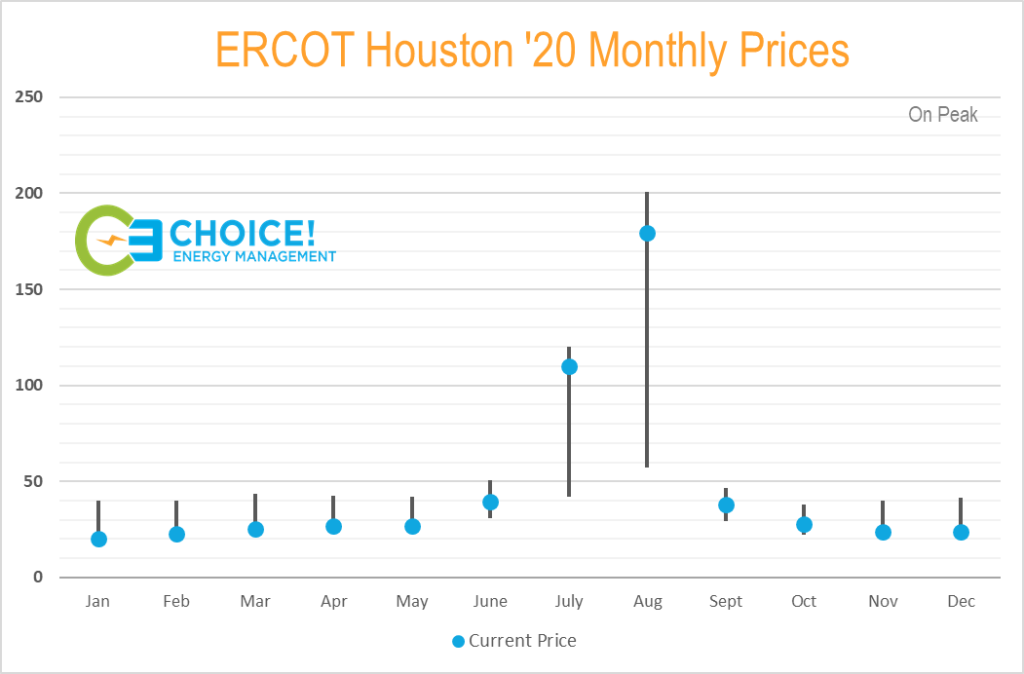

ERCOT: The latest report on Capacity, Demand and Reserves for ERCOT has projected a 10.5% reserve margin for summer 2020. The margin is projected to loosen to 15.2% and 13% in ’21 and ’22 respectively. Lost base-load generation from coal retirements has not fully been replaced by natural gas fired units. The renewable build-out has been substantial and is expected to grow to 15% of all generation utilized by the end of 2021. Low regional natural gas prices have created a scenario where power prices are near decade lows for all but the summer months. To entice new capacity, generators will need to be profitable in all months of the year, something that is hard, given the low prices 10 out of the 12 months (see below).

PJM: The current battle between the PJM regulators and the Federal Energy Regulatory Commission (FERC) over renewable energy subsidies distorting the market will likely not be solved soon. FERC’s latest order of expanding the Minimum Offer Price Rule (MOPR) aims to ensure competitive generation investment but may simply be an indictment of the flaws in the PJM forward capacity pricing structure. The outcome of the expanded MOPR will likely beget more regulations from state legislatures, and PJM futures prices will be susceptible to the stroke of a pen.

The depth of nuance affecting prices in region specific power markets is enough to make even the most avid energy blog connoisseurs head spin. The topics discussed in this blog warrant much deeper discussions than the individual paragraphs present. From 2014 to today, the soft trickling whisper generated from the impact of renewables has grown to a small but roaring stream. Time will tell how choppy the waters will get but there is no denying the potentially volatile effects of incorporating renewable energy into regional ISO’s. Until the day analyzing power markets becomes black and white, see what more Choice! can do to ensure smooth sailing.

Confidential: Choice Energy Services Retail, LP.