by Matthew Mattingly

Budgeting & Forecasting is an essential part of a comprehensive energy consulting program. This service not only ensures clients have an accurate picture of their future energy spend, but it also allows clients to effectively evaluate future energy contracts. Many energy consultants offer “budgeting” or “forecasting” as one of their services, but only a select few are able to correctly forecast energy prices. The key is an accurate forecast of monthly NYMEX settlement prices. No other variable affects the energy landscape like the NYMEX contract. The NYMEX is the component of most retail natural gas contracts, it effects the movement of natural gas basis markets, it’s correlated to utility energy costs and moves the needle in forward electricity prices. Plain and simple, the NYMEX is a big deal and Choice Energy Services forecasted it correctly in 2017.

Before we pat ourselves on our backs too much, let’s be honest with ourselves, NO CONSULTANT is going to PERFECTLY forecast the NYMEX natural gas settlement price EVERY SINGLE month. If a consultant could call the NYMEX every month they wouldn’t be working in the retail energy industry. Rather they would be trading, and likely making enough money to buy their own beach and sipping on their favorite cocktail every day. However, just because it’s nearly impossible to predict the NYMEX accurately every month that doesn’t mean all consultants are created equal. Choice Energy Services’ team of analysts relies on past and present fundamental data, statistical and technical analysis, all while utilizing our relationship with OTC Global Holdings and EOXLive, to provide budgets for our clients. This information provides our clients with an accurate view of the NYMEX price, which especially was the case for our clients’ 2017 budgets.

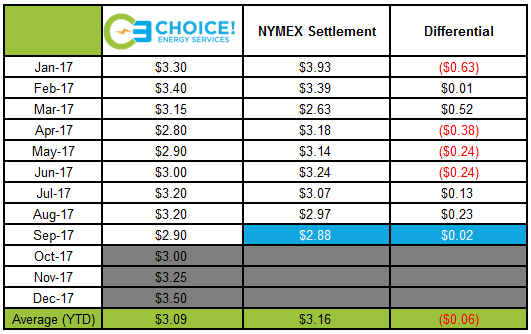

The finalized Choice Energy Services 2017 NYMEX Outlook was published on October 20, 2016. The report is still available to review in the White Papers section of our website, but also listed in the below table. The below table includes the Choice’ forecasted price in comparison to the NYMEX settlement. The table also includes the September 2017 NYMEX price (highlighted in blue), although it does not officially settle until Tuesday, August 29, 2017. From the chart we can quickly determine the following…

- Choice Energy Services accurately forecasted the NYMEX settlement price within a quarter ($0.25) in six out of the nine months.

- The February 2017 NYMEX forecast was within a penny of the actual settlement price. September 2017 settlement is looking to have a similar result.

- The Year to Date (Jan-Sep) average only differs by $0.06/MMBtu.

- March and April 2017 would have been close if the numbers were flipped. A warmer January and February caused the March NYMEX settlement to drop further than expected, while a cooler than expected March cause the increase in the April NYMEX settlement.

- The only outlier is January 2017, caused by extreme cold temperatures at the very end of calendar year 2016.

The Risk Management team of Choice Energy Services did a great job forecasting the 2017 NYMEX settlement prices. However, there could be some cynics questioning the difficultly of forecasting the NYMEX. For those naysayers, I would like to point out several very talented and reputable analysts that DIDN’T forecast 2017 correctly…

- Jim Cramer Says 2017 Is Year of Natural Gas

- RBN Energy “The natural gas forward curve is mispriced (too low)”

- Forbes Contributor Arthur Berman “Days of Cheap Natural Gas Are Over”

Budget season is right around the corner for many, so it’s a good time to ask yourself “who should be working on our company’s budgets?” Our recommendation is to find a consultant with a proven track record in forecasting NYMEX prices; a consultant such as Choice Energy Services. Until you make your final decision, take a live look at our Risk Management office as they celebrate their accuracy of forecasting the 2017 NYMEX monthly settlements….

Confidential: Choice Energy Services Retail, LP.