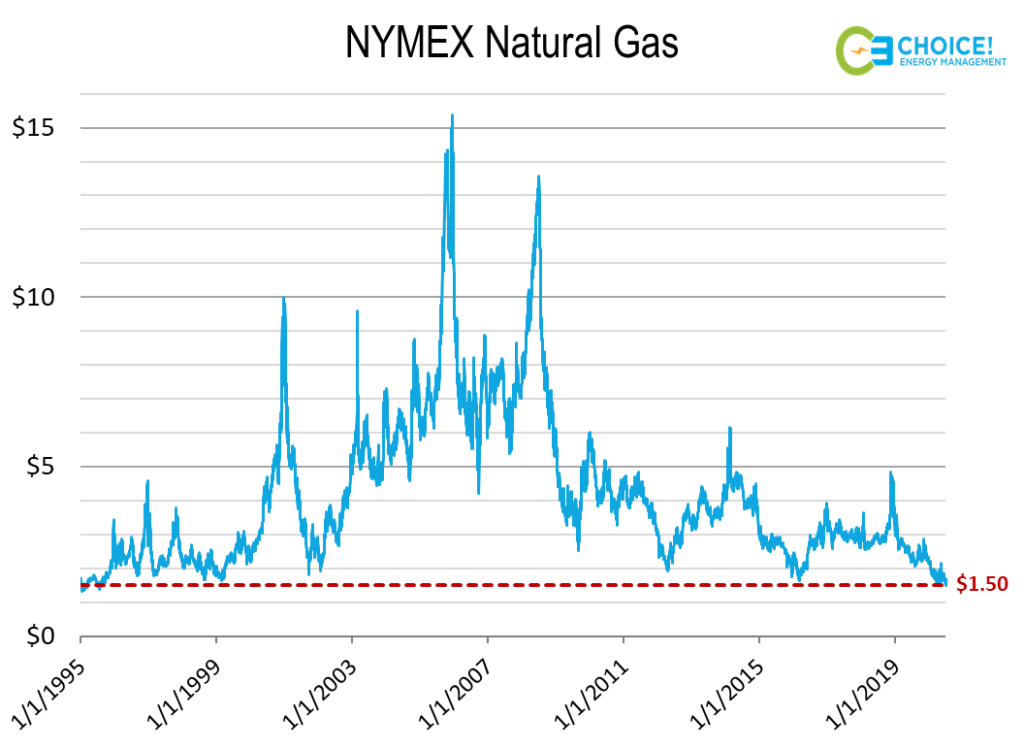

The only thing that could make 2020 more unbelievable would be massive alien saucers hovering over major US cities. COVID-19 continues to linger, election rhetoric is heating up, and NYMEX Natural Gas just broke the record for its LOWEST MONTHLY PRICE SETTLEMENT IN 25 YEARS. With the July contract settling at $1.495/MMBtu, preconceived notions about this market have been shattered, and we face the rest of 2020 with a high degree of uncertainty. Can Will Smith swoop in and end this alien-like hold the bearish fundamentals have on this market? To be determined, but what is certain is that this natural gas market is sending up fireworks of the likes never seen.

2020 was supposed to be the year of growth for all things natural gas. Growth expected on the demand side from electric power burn, liquefied natural gas (LNG) exportation, and pipeline exports to Mexico. Growth in production expected to make up for the new demand. Rather, what we have seen is a COVID-19 induced, massive decline in nearly every fundamental. LNG is down 70% from projections, production down 10% and industrial demand down almost 20% has given us a slowly balancing but still over-supplied market. This supply glut hangs over the global natural gas market like an ominous flying saucer and poses a serious financial risk to all that dare oppose it.

So, what of this pricing record? Last week we saw a massive injection of 120 BCF of natural gas into storage, exceeding expectations and all previous norms. This event, coupled with the fundamentals discussed, and moderating weather forecasts last week, pushed the NYMEX July contract to a low of $1.432 before settling last Friday at $1.495. This is the lowest settlement we have seen since the August 1995 contract that settled at $1.49 (a year before the cinematic classic we call Independence Day was released in theaters). These are price levels previously believed unreachable in our modern market. This bearish confluence of events has moderated, and we have now seen a rebound in the August contract to $1.70 on forecasts of a top 5 hottest July.

In many ways, the NYMEX Natural Gas market is a victim of its own success. The ability to quickly and cheaply produce natural gas has pushed producers to sell at rock-bottom prices. These market prices are unsustainable for long periods of time without irrational factors at play, but there has yet to be much rationality in the year 2020. In a way, maybe the crude 1990’s cinematography and plot line of aliens coming to harvest the earth for its natural resources is a believable analogy for this natural gas market. Will the market shake out by winter? We have our predictions, but for now, we are left waiting for the rest of this market/movie to unfold.

Confidential: Choice Energy Services Retail, LP.