By; Chris Amstutz

We interrupt your regularly scheduled broadcast to inform you that energy markets (and everything else for that matter) are going crazy once again. What better way to convey market volatility, than through the catchy, over-dramatic song released by R.E.M. in 1987? Perhaps you glanced over our previous calls to action here, here, and here, but now the threat of war in Ukraine exacerbating already high energy prices has you reevaluating your company’s energy strategy. It may feel like the end of the world as we know it, but the consultants at Choice! have the experience and technology to enable your business to ride out these wild times. Let’s briefly dive in to how current global affairs can affect U.S. energy markets and your bottom line.

The Back Story

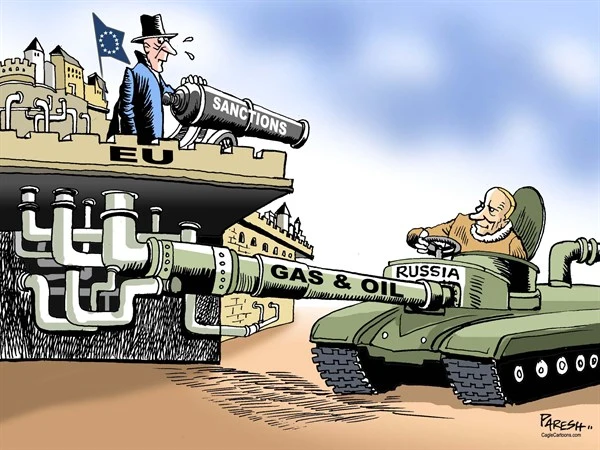

- Russia has invaded Ukraine at a time in which global oil and natural gas prices have been near record highs. Petroleum exports largely fund the Russian government.

- “Weaponization of Commodities” is the fear that Russia could cut energy exports to Europe and the U.S. causing increasing inflationary pressure and power black outs in Europe.

- Global energy prices will be volatile with every piece of news from this conflict, and this will directly tie back to U.S. natural gas and power prices.

U.S. Pricing

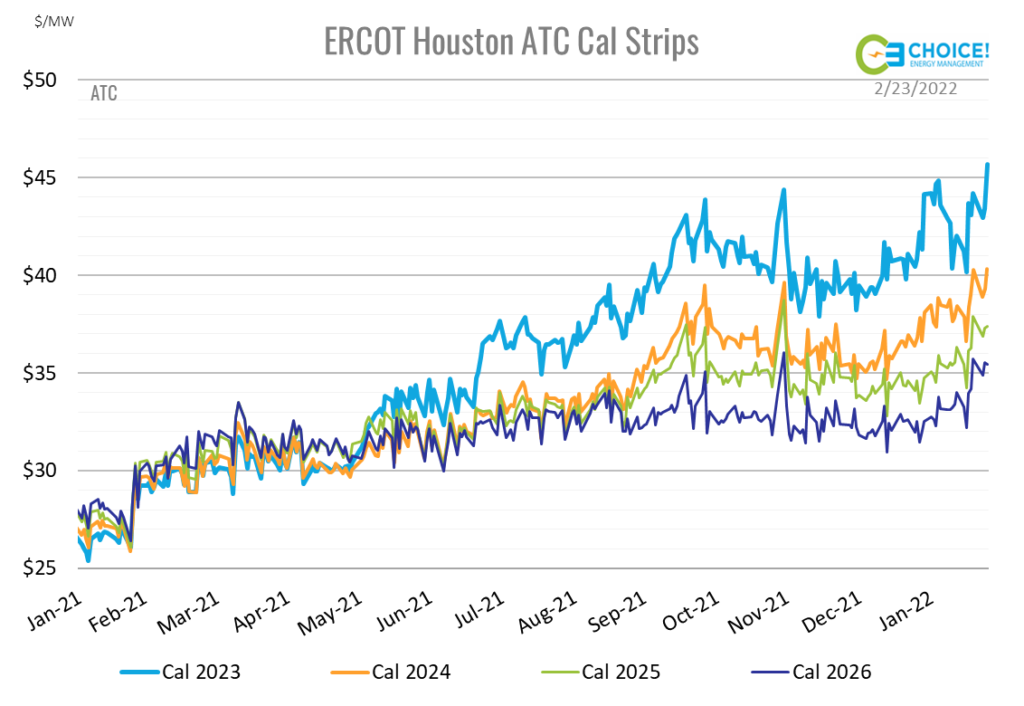

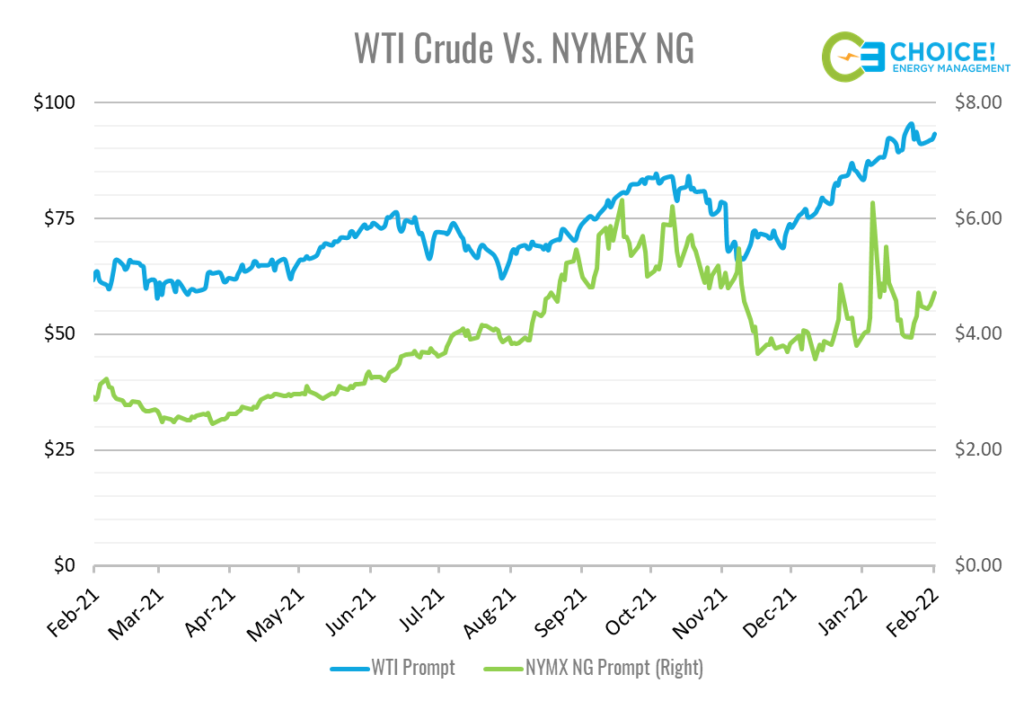

- The March NYMEX NG contract traded as high as $4.95 today on fear of the conflict in Ukraine, pulling calendar strip 2023 & 2024 up to contract highs of $4.03 and $3.49 respectively.

- Europe and the UK have seen power and natural gas prices spike 60% today, to the highest prices on record. €342/MWh for their April contract will increase inflation across the pond.

- Options trading for the NYMEX Henry Hub November 2022 contract (start of winter) is indicating a range of outcomes from $3.35 – $6.15/MMBtu

- Due to Natural Gas being the main input fuel for generation, electricity prices will continue to rise nationally. Tariff rates will have a slightly lagged effect in rising, and it could be wise to lock in prices now to hedge against these volatile, uncertain times.

U.S. Supply and Demand

- WTI Oil briefly touched $100/barrel this morning on news of the conflict. At this price level, new drilling is profitable in ALL U.S. producing regions.

- U.S. producers could increase oil supply by 10% by the end of 2022, and natural gas supply by as much as 5%. This increase will be needed in the market and would halt rising prices.

- While the U.S. cannot export more than the current 13 BCF/D level, upward global pressure of prices above $40/MMBtu will keep the risk premium in place for the U.S. markets. This risk premium is due to the possibility of needing to keep this supply stateside if a future shortage occurs.

- The White House has changed tune recently, asking U.S. producers to increase oil and natural gas output to offset Russian supply globally.

In any market there are quantitative markers (pricing, supply/demand) and there are qualitative markers (trends and historical precedent). We are currently experiencing extreme volatility in the energy markets and a marriage of quantitative and qualitative analysis is needed. Choice! Energy Management is in a unique position to consult your business from an angle of qualitative experience, and from the angle of technology based quantitative analytics. This ensures that your business is able to save the maximum amount of money across the energy landscape, adding emphasis to the “and I feel fine” part of the “the end of the world as we know it” line.