By: Chris Amstutz

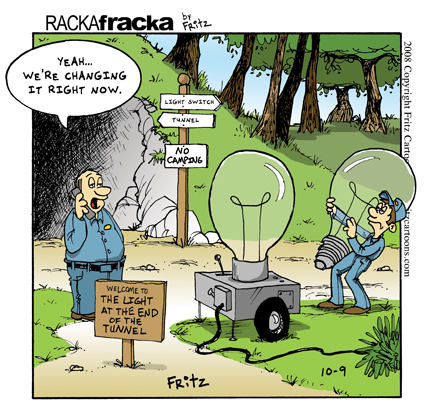

Opinions are circulating that 2020 has been the worst year ever. Extreme maybe, but the roaring 20’s is certainly off to a rough start for the country (and natural gas price outlooks). The good news? The light at the end of the tunnel is in sight. For two months now we have been in the Tunnel of Terror (as we mentioned in our last blog), and only now are a few trends popping up. COVID-19 restrictions are easing, allowing people to emerge from their Netflix/Hulu/HBO binging solitude. This is allowing for a clearer outlook on the fundamentals affecting the NYMEX natural gas market. Are we out of the tunnel of forecasting despair yet? Certainly not. Expect more records to be broken before we reach the end of this madness. More good news? We are nearing an advantageous time to save your business money through the strategic management of your energy procurement.

Looking Back into the Darkness

Stay at home orders may be boring, but following the markets has not been. The volatility witnessed in the last 2 months has been unlike anything seen in our lifetimes. Here are some of the records that have been broken pertaining to the natural gas market:

- Record low daily temperatures for half of the U.S. on May 9th.

- The WTI May oil contract went negative on April 20th for a -$37.63 settlement.

- Unemployment sits at 14% nationally, and the Fed Chairman warns this could rise to 25%.

- Several projections have the natural gas storage level breaking the record high of 4,047 billion cubic feet (BCF) by November.

- The streak of 76 trading days of NYMEX prompt under $2 was broken on May 5th but has since fallen back below the mark.

Looking Forward for the Light

The glimmer of freedom and summer bliss has been revealed to many recently. As we learn more about COVID-19, the implications ripple through energy market fundamentals and ultimately prices. The dark tunnel of uncertainty has become a little brighter. Here are some ongoing trends we expect will continue to affect the natural gas market:

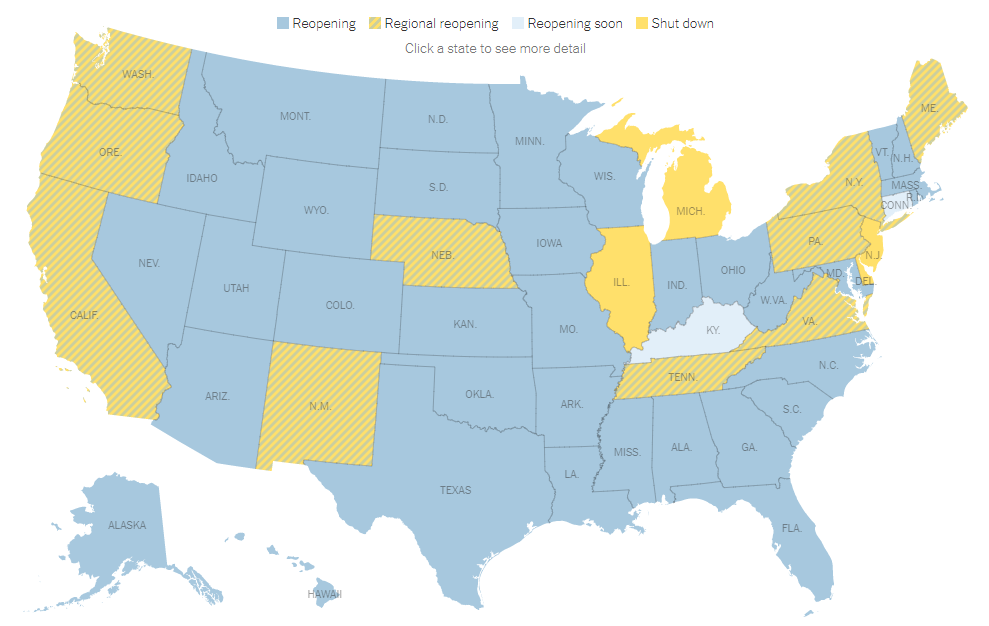

- All but 5 states (NY, NJ, CT, MI and MA) have begun some sort of reopening measure. It may be 2 more weeks until any state has fully opened all businesses.

- Non-weather demand for natural gas has fallen. Industrial demand is expected to slowly recover as the economy picks up, but it may not be until 2021 for exports to recover. Liquified Natural Gas exportation (LNG) has led the way with only 60% of capacity utilized in May, falling to potentially 45% by end of summer.

- Production could fall as much as 5% in 2020. This is a substantial drop but has recently been less than the fall in demand we have seen, maintaining the short-term bearish market. A recovery in oil prices could keep this loss of production from being fully realized.

The adage of “volatility creates opportunity” is certainly at play here. Any business that can look forward for the light at the end of this virus-induced tunnel will benefit from an experienced energy market consultant. The twists and turns we have seen recently have been extreme and gone are the days of passive procurement management. Through Choice Energy Management’s analysis of market fundamentals and historical trends, even the darkest of tunnels can be illuminated. While uncertainty still abounds in the NYMEX Natural Gas Market, feel free to reach out to a Choice! consultant today regarding your business’s energy management options.

Confidential: Choice Energy Services Retail, LP.