By: Matthew Mattingly

A proposed game changer in the natural gas industry, LNG exports, is set to begin in the United States next month. That is when the Cheniere Energy, a Houston based energy company, is scheduled to start its first production train at the Sabine Pass project located at the Louisiana/Texas border. The export train is the first of five total trains at Sabine Pass, and seven total trains for Cheniere Energy will come on-line in six month intervals until final completion in mid-2019.

The process of turning the methane gas into an ultra-chilled liquid fuel easy for transportation was originally thought to provide stability to the supply/demand imbalance in the natural gas industry. However, with natural gas pricing plummeting on the heels of record production and an El-Nino driven mild winter, producers are looking for any bullish signals that would alter the current direction of pricing. One would think the news of LNG exports would be welcoming news to the market. However, at this moment the NYMEX natural gas market could care less about LNG exports.

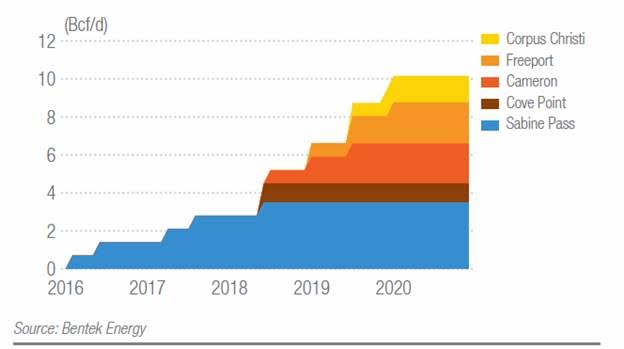

The apathy for LNG exports is quite clear. Although the LNG export process begins in the United States in 2016, the process will take time to grow. As the US LNG Export Capacity graph (provided by Bentek) illustrates below, the Sabine Pass will be the first export facility in the United States in 2016. However, it will be til mid 2017 before it’s able to reach 2 Bcf/Day in export capacity. Furthermore, it will be an additional year for the next LNG export facility to be on- line (Cameron and Cove Point) and it will be 2020 before the United States reaches 10 Bcf/Day in export capacity. Take into consideration that the United State produces 10 Bcf/Day more than it did just two years ago, one can see why no one really cares about the first LNG export terminal starting in 2016.

The approval and construction of LNG export facilities is a time consuming process that takes years to implement. Due to that, it will take time for LNG exports to have a large impact on the supply/demand imbalance with natural gas in the United States. In time LNG exports will have an impact on the market, it will just not be in 2016.

Confidential: Choice Energy Services Retail, LP.