By: Matthew Mattingly

The ever-changing energy landscape has proven its prowess again with the recent evolution of Liquified Natural Gas (LNG) markets. Staying ahead of these trends requires a voracious reader willing to scour articles, blogs, and even Twitter. Books are slightly less of a requirement yet, I recently found myself reading Meghan L. O’Sullivan’s recent published book, Windfall. The book discusses in great detail the benefits that the fracking revolution (not my favorite expression) has had in the United States, and the domino effect it has had on the rest of the world. The globalization of gas markets through LNG has created winning countries and losing countries (including our shirtless Siberian friend), and the implications are numerous. This book reminded me of how much the U.S. natural gas market has changed in my 15 years in the industry. For these reasons, Choice! Energy Management closely tracks LNG metrics and provides monthly commentary on how news in far away lands can now affect Risk Management strategies for our clients.

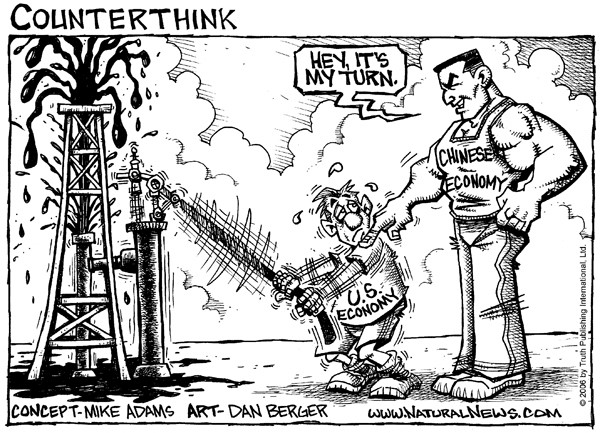

Winner: China

Napoleon famously said “China is a sleeping giant. Let her sleep, for when she wakes, she will move the world.” China has awoken and is now a fierce dragon. China’s growth in the 21st century is remarkable, with now the second largest GDP requiring large sums of fossil fuels that it does not possess within its borders. The book Windfall discusses China’s initial “going out” strategy of investing in production in Latin American and African countries. In the meantime, China’s booming economy collided at a perfect time with the United States’ fracking boom, allowing for robust LNG imports. China now has access to the United States’ 12 BCF/Day of LNG capacity, when in previous times they suffered shortages. Demand has still outpaced supply in the LNG world, leading to prices of $12 – $20/MMBtu for China, compared to roughly $3/MMBtu in the U.S. This cost will continue to fall as natural gas markets globalize bringing prices closer together.

Winner: Europe

Many European nations would prefer to move away from natural gas due to climate policies, but demand is still strong. Even as a “bridge fuel” to carbon neutral goals by 2050, the EU will be burning 550 billion cubic meters annually in 2021 through 2025. Supply is heavily dependent on Russian imports (over 40% of Europe’s natural gas supply). With such a strong reliance on Russia’s fossil fuels, European nations have been reluctant to fight Russia/Putin on policy conflicts (see Ukraine gas conflicts/cuts in 2006, 2009, and again in 2013). However, with a growing supply of LNG available, Europe has a new partner in the natural gas supply game. Europe can now diversify their natural gas imports, with the United States becoming a larger player. Windfall projects the United States to represent 18.9% of Europe’s gas imports by 2025. If nothing else, the additional LNG supply provides Europe negotiating ground against Russia, as recently seen with Nord Stream 2 pipeline.

Loser: Russia

To say Russia relies on fossil fuels would be understatement. Oil and natural gas account for more than 60% of Russia’s exports and provide more than 30% of the country’s GDP. The last thing the former Soviet Motherland wants is an oil and gas competition, but that is what it is getting thanks to the United States shale revolution. In a similar fashion to the oil price collapse in 2014, U.S. LNG is gaining global market share, pushing prices lower. This is hindering Russia’s leverage on pipeline project negotiations like Nord Stream 2 to Europe and Power of Siberia to China. Additionally, it is causing delays in their own LNG export terminals (Valdivostok LNG Project). These pipeline and LNG projects are being reviewed as the financial benefits to Russia are not as strong, thanks to U.S. competition.

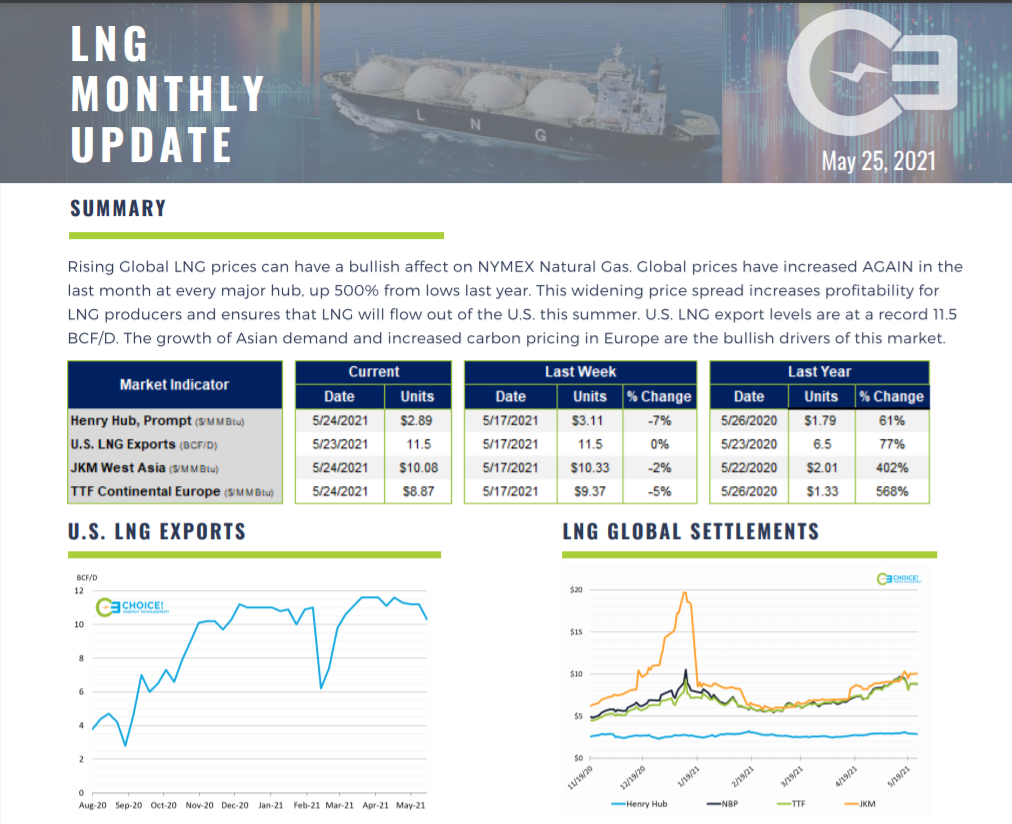

Choice Energy Management – LNG Monthly Update

LNG exports have been a game changer for the U.S. natural gas market, and also for the rest of the world. This has not been lost on the team at Choice! Energy Management, as we have written about the topic for years. To highlight the growing trend, Choice! now provides a monthly LNG Report to its Risk Management clients, showing export levels, U.S. export terminals, and global hub prices. You can access the LNG Monthly Update here or talk to your consultant on how to gain access to the report.