By: Chris Amstutz

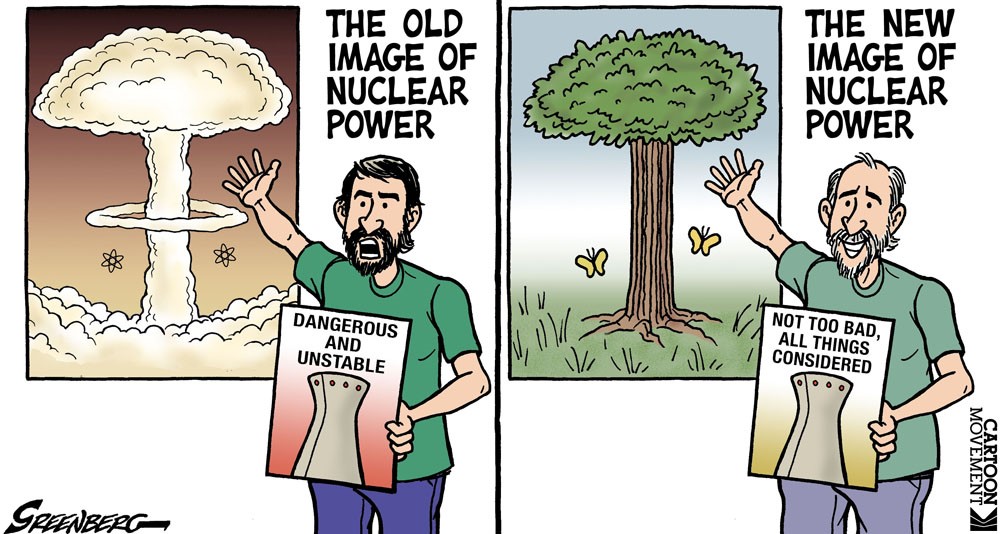

What images come to mind when you hear the term “Nuclear Power”? If it is 3 eyed fish, rivers of fluorescent glowing matter or people in haz-mat suits, you aren’t too far off from most people. Shows like The Simpsons have been painting a satirically negative view of the nuclear industry for decades and environmental groups are quick to join the bandwagon. Nuclear power makes up 20% of the United States’ electricity generation, but is often only discussed when something catastrophic happens. Is Nuclear power dying out and what are the implications? The Choice Analysts are always watching for interesting new developments in the energy markets and the recent news out of Georgia has us questioning the role of nuclear-powered electricity generation in the United States and its’ potential future.

We reported on nuclear power in the July 2017 Bulls and Bears Report and the section was titled “The Death of Nuclear” (harsh, we know). Since that time, little has changed in the outlook for the nuclear power industry except a late December ruling from utility regulators in Georgia. The decision is an approval for the Georgia Power utility to finish the two, long-delayed nuclear reactors that have already cost the rate payers of Georgia billions of dollars. The impact of this decision is being called a lifeline for nuclear power. The decision was made under much controversy but is emphasized as the right choice by regulators, given the context of the project. Regulators cited the fact that despite the hefty upfront costs, current nuclear reactors have outperformed the projected cost benefit in Georgia.

The main argument against construction of new reactors is that the power takes decades to show a favorable return on investment, versus natural gas at current fuel costs. Heavily simplifying the math of the scenario, it is estimated that a nuclear reactor could have over 10 times more fixed costs than a natural gas fired plant, but once finished, Nuclear power could save over 20% on fuel costs over its’ life time (For a deeper understanding here is another link). The many moving projections are what make the future value calculations tricky, and even more so when factoring in social costs/benefits, like decreased CO2. The scenario in Georgia really boils down to the fact that Georgia Power made a conscious decision to continue an already troubled nuclear project, in the context of a rapidly evolving electricity generation environment. This is a gutsy call and would need some market support to prove financially wise.

Does the US really need Nuclear energy? Should we be improving nuclear tech and approving more sites? These seem to be the billion dollar questions. Almost all of the nuclear reactors in the US are nearing the end of their lives, so this question will have to be addressed in the coming decade. If not nuclear power, alternatives would surely include increasing natural gas-fired power generation or some other sort of fossil fuel. (Insert environmentalist outrage here). Another option would be increasing battery storage capacity to help promote renewable energy, though battery capacity technology is not advanced enough at this time to make this a solution at the macro grid-level.

Whether you love or hate Nuclear power, the facts still remain that it is a prevalent, non-carbon emitting, reliable and long term cheap source of energy. It is examples like the decision in Georgia that remind us, that despite the overwhelming regulations and negative press, maybe Nuclear power isn’t dead yet. As energy market analysts, the watch (and wait) continues for changing perceptions and the ultimate fate of the nuclear power industry.

Confidential: Choice Energy Services Retail, LP.