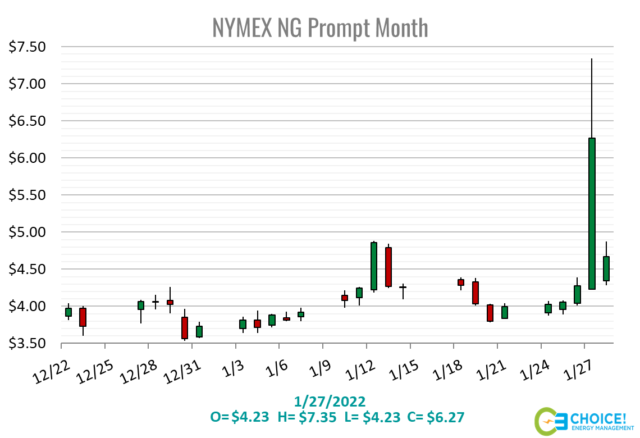

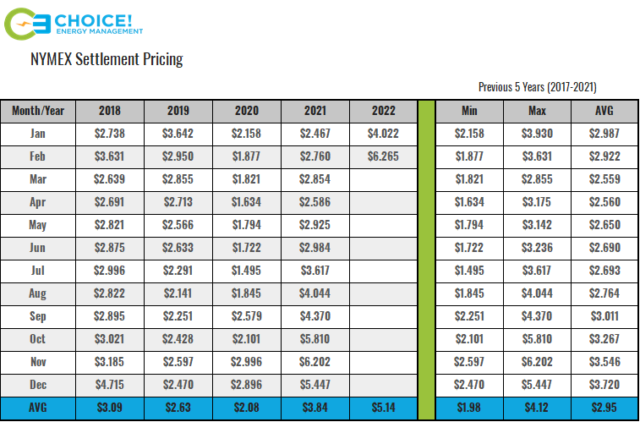

In the trading world the candlestick graph depicts the intraday price of a stock/commodity at opening, highest point, lowest point, and settlement. The January 27th, 2022 candlestick for the February 2022 natural gas contract was ONE FOR THE BOOKS, highlighting just how volatile this market has become. A flurry of events in the last 30 minutes of trading yesterday took the February 2022 contract from $4.23/MMBtu at opening, to near $4.60 by 2 PM EST, to an astounding high of $7.35/MMBtu by 2:20 PM EST, to a final settlement of $6.265/MMBtu at 2:30 PM EST. This monthly settlement is the highest since December of 2008 and does not reflect where the commodity has traded in the last 30 days, at near $4.00.

Settlement day for specific natural gas contracts typically brings extra volatility, but not usually to the magnitude of yesterday. Over the last 14 months, the final day of trading for a contract has seen an increase of $0.18/MMBtu on average, with 3 of the last 5 months having risen by more than $0.45/MMBtu. Yesterday’s intraday rise of $3.17 is the highest since 2003, and the $2.03 (45%) rise to settlement is THE LARGEST DAILY PERCENTAGE INCREASE IN THE HISTORY OF THE COMMODITY.

So how does this happen? Choice! Energy Management’s insights in to the trading and retail energy sectors give us a unique ability to help dissect this historic event. In short, the lack of liquidity in the market yesterday (partially driven by increased regulation in the trading market) likely allowed a short squeeze to turn in to an algorithmic (computer trading) spiral upwards in to close. EBW Analytics wrote this morning, “The spike higher carries all the hallmarks of a short squeeze, with traders short into expiry forced to buy gas at any cost to cover their obligations. In a thinly traded market, however, little gas was available—forcing shorts covering their positions to bid prices higher. February eventually traded hands at $7.346/MMBtu.”

The implications from yesterday’s trading will be felt for months to come. This event will likely be looked at further by regulators, as the implication of this settlement price will be felt by residential, retail, and industrial consumers across the U.S. and globe. This event strikes fear into what has historically been a market driven by fundamentals (supply/demand). This new found risk shows the importance of locking in future prices to avoid these spikes. Budget certainty and hedging against this market that has now shown a 45% daily swing in price is more important than ever.

Featured Image Credit: WANG ZHAO—AFP/GETTY IMAGES