by Matthew Mattingly

Let’s be honest with ourselves, 2015 was a boring year for natural gas trading. Once the bottom fell out of the NYMEX market at the beginning of the year, trading remained range bound for the majority of the year. Finally, when the natural gas market did experience some movement it was only further advancement to the downside. Prompt month gas broke through the $2.50/MMBtu support level and even traded below $2.00/MMBtu in December 15. This is a far contrast from 2014 that saw large movement in natural gas trading. However, will this continue in 2016?

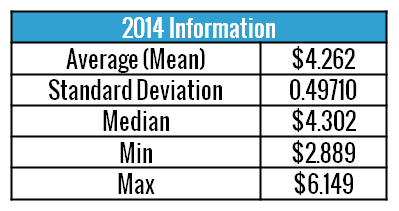

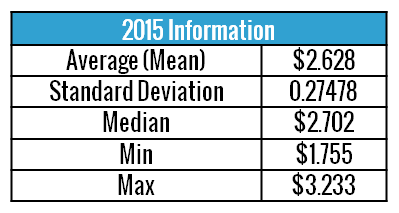

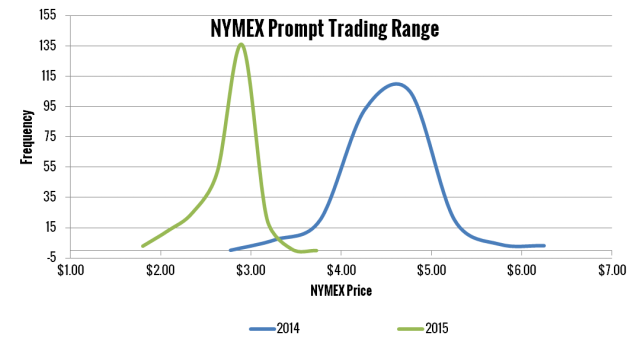

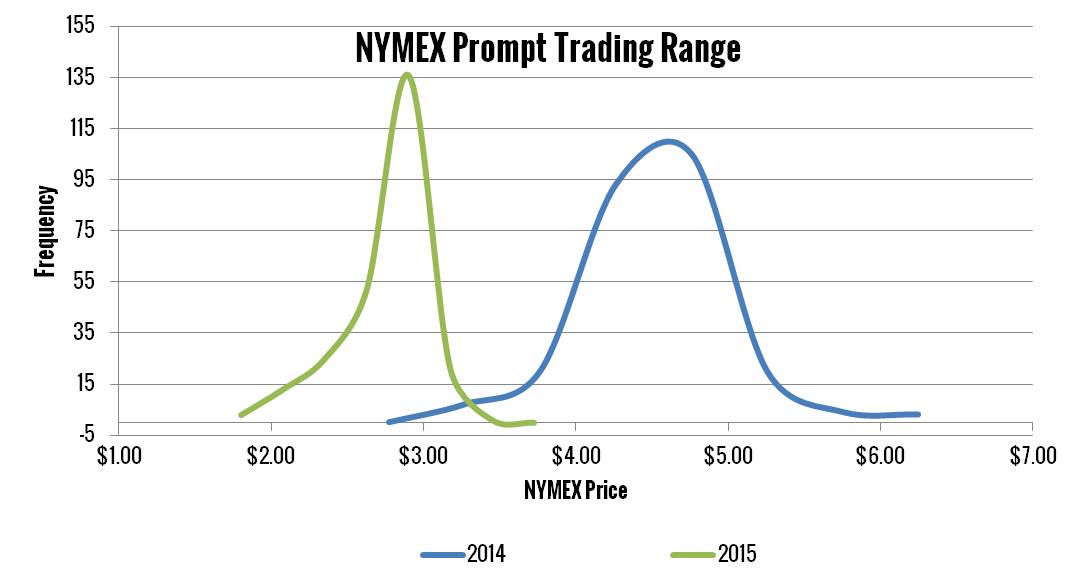

2014 natural gas trading was very volatile, mainly due to one factor: The Polar Vortex. The Polar Vortex has been discussed to death in the natural gas world, so I will not go into detail about the weather event. All one needs to know is that the Polar Vortex brought pipeline constraints (especially in the Northeast) and depletion of natural gas storage. In return, this led to elevated pricing in the natural gas market during the 2014 winter. Prompt month natural gas traded as high as $6.149 causing a wide range in pricing for the calendar year. The 2014 NYMEX stats and figures are listed below, but I will highlight the standard deviation in pricing was nearly $0.50/MMBtu for the calendar year.

In contrast, 2015 was anything but volatile. As the stats and figures illulstrate below, that range and standard deviation was much smaller in 2015 for NYMEX promot trading. In fact, it took a further collapse in pricing at the end of the year to widen the incredibly tight range. The bell curve further highlights the differential between the two years showng the tight range and lower pricing in 2015.

So, what does this mean for 2016? 2016 is continuing the same trend from 2015 with trading remaining very range bound (January and February typically are volatile trading months in the natural gas market). A mild winter, strong production in the face of declining rig counts, and strong inventory levels have prevented any uptick in the market. This is good news for end-users who are taking advantage of the lower commodity pricing. However, it could also be giving end-users a false sense of comfort in regards to NYMEX pricing. End-users are becoming complacent and increasingly reluctant to secure pricing in the forward market, believing current conditions will be the norm. Staying focused on one’s clearly defined risk goals and objectives are important, preventing any false sense of security since the market will not remain this way forever. It may be in a few months, at the end of the year, or even next year, but in time the market will react to bullish factors and begin to rise.

Confidential: Choice Energy Services Retail, LP.