By: Matthew Mattingly

I often get asked what separates Choice! Energy Management from our competition. Usually I respond with the word “Strategery” to describe our services. Not only does it typically get a smirk from those that remember the classic Bush v Gore SNL skit, but it gets people to quickly associate Choice with a key service offering: STRATEGIC PROCUREMENT. While electricity and natural gas procurement have been the backbone of energy consulting since deregulation began in the 1990s, not every consultant is strategic with their energy procurement recommendations. Countless times I have walked into a prospective client’s office, and been told that their previous consultant only provided them with the minimal effort process of procuring 30-60 days prior to contract expiration. What is strategic about that?

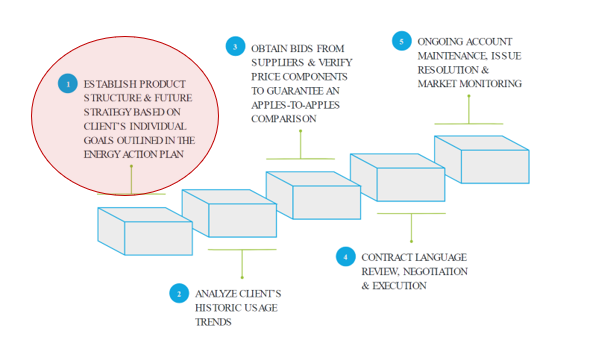

The Choice Way

At its core, the procurement process looks similar for many energy consulting companies. The analyzing of a client’s usage is followed by obtaining and verifying bids, and then reviewing and executing the procurement contract. However, many miss the first, most important step of the TIMING of the RFP. This is where we at Choice! Energy Management differentiate ourselves from the competition. We truly take the time to understand our client’s risk tolerance, financial goals, and objectives, and then develop a procurement plan around this profile. Once that Energy Action Plan is established with our clients, we then evaluate each energy market area, determining opportunities that may exist. The right timing window in certain market areas can be as razor thin as vote counts in Florida, but our market experience ensures that no recounts are needed after execution. This allows us to guide our clients through each purchase decision, and the client becomes a price setter and not a price taker.

Detailed Market Analysis

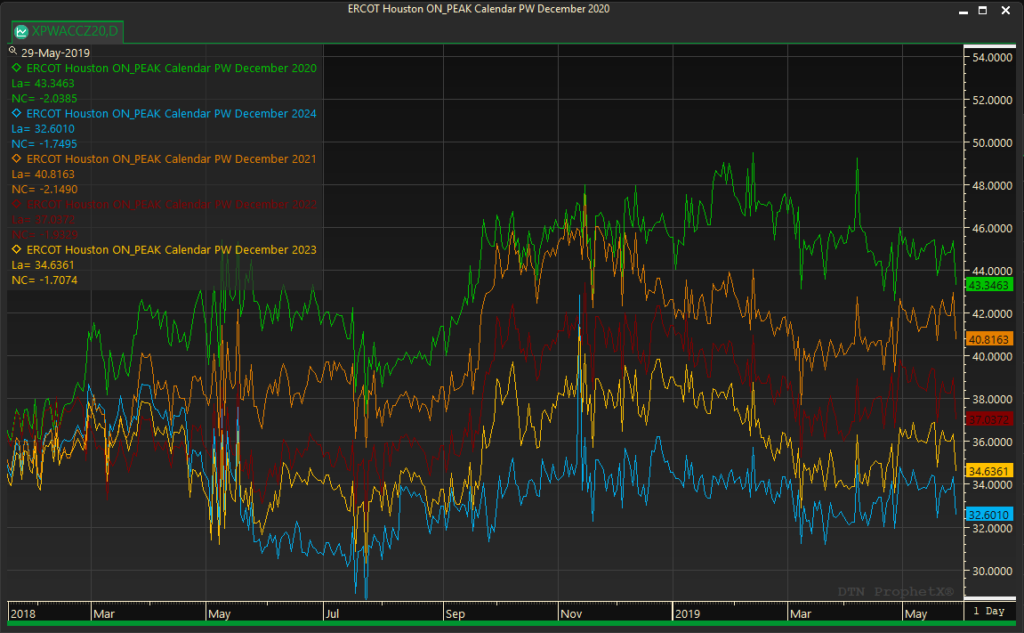

The analysts at Choice pride themselves on the insight and value provided to clients. An example of this analysis has been our ongoing work with clients in Texas. The Texas electricity market has changed a lot over the last couple of years, sort of like the GOP. Coal retirements, West Texas demand growth, delayed natural gas generation projects, and renewable generation growth have resulted in much tighter reserve margins causing dramatic price movements in the ERCOT market. However, that doesn’t mean that opportunities do not exist in this market area. Through constant monitoring of forward curves provided by our sister company, EOX Live, our procurement team has utilized the backwardation that currently exists in the ERCOT markets to our clients’ advantage. With most of the reserve margin fears focused on 2019 and 2020, wholesale electricity curves are trading at a discount in the extended curve when compared to the prompt 2020 calendar strip (see chart below); thus, giving clients attractive contracts in 2021 and beyond. Many of our clients are taking advantage, and are thankful of our team presenting options, even if their current contract is not expiring anytime soon. Many times our clients are beating their current contract, and are also gaining budget certainty and price protection.

Graph: Choice! Energy Management via ProphetX Platform

If your energy consultant’s procurement decisions have a consistent pattern of waiting until 30 days prior to contract expiration to execute, then it might be time to look at other consulting options. Our team would love the opportunity to present to you our full energy management program, centered on STRATEGIC PROCUREMENT. Don’t get fooled by the same lack of procurement service. As our great, 43rd President once said…… “Fool me once, shame on…shame on you. Fool me — you can’t get fooled again.”

Confidential: Choice Energy Services Retail, LP.