By: Chris Amstutz

Many believe that we are at a crossroad as a species due to CO2 emissions from fossil fuels. Plans such as the Green New Deal and other energy sector de-carbonization plans have been in the news lately, but surprisingly none have included ideas about nuclear power. In our first blog, Nuclear Power: The Half-Life of an Industry, we discussed public opinion and the economics of nuclear power. Since that time we have seen more of the same negative public opinion, and a greater political push for de-carbonization. Shows like HBO’s Chernobyl continue to cast a negative light on a technologically established energy source that could help assist in accomplishing these political goals. Opinions aside, the debate over nuclear energy continues, and Choice! Energy Management is monitoring the implications of any potential regulatory changes.

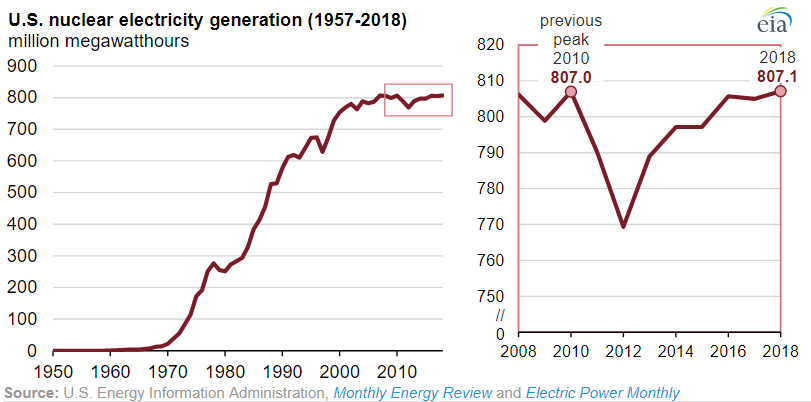

Many who saw HBO’s latest series “Chernobyl” were horrified by the visualization of the failed Russian power plant (cue the show’s creepy soundtrack). While it may have been great for TV, this popular show was blamed for misleading public opinion when it comes to the industry (see what they got wrong here). For many, this becomes their sole opinion about nuclear power. While it is unknown if public opinion has really hampered the industry, it is known that subsidies granted to other carbon-free energy technologies, and the growth of natural gas fired generation, can be to blame. Critics of nuclear power argue that nuclear facilities give off radiation that can result in cancer, and even Seinfeld couldn’t make that a joking matter. Disposal of spent uranium is also a point of criticism. For these criticism’s we turn to some “alternative facts”. US nuclear power has provided reliable, carbon-free energy for 20-25% of our electricity for the last 20 years. For comparison, in 2013 all other carbon free electricity sources totaled 12% and today are up to 19%. Nuclear facilities require significantly less land space and also have less physical impacts on wildlife than solar and wind energy. Also, when you factor in the reliability and ability for electricity to easily be dispatched when needed, nuclear could certainly assist with the movement towards a carbon-free grid.

The Presidential election of 2020 nears and climate change policy has been in the platform of most Democratic candidates. This policy debate will center on the energy industry and many may come to the conclusion that renewable energy technology is not sufficient at this time to meet ambitious political goals. The next step would be an evaluation of the carbon free benefits of nuclear power. While the EIA is forecasting a 17% reduction in nuclear generation over the next 5 years, recent news in Ohio about First Energy postponing the retirement of two nuclear facilities has many in the industry hopeful for future government support. Currently, there is 1,670 Megawatts (MW) worth of nuclear generation capacity being built or planned to be built in the next 5 years. This is countered with 8,312 MW of capacity (8% of total) planned for retirement in the next 5 years. A trend that is not likely to reverse without the help from market forces i.e., an increase in Natural Gas fired generation cost, or a government policy change i.e., a subsidy for carbon free power.

Is nuclear power the most underrated energy source we have in the US? Maybe, but the amount of nuance in electricity markets necessitates proper analysis. If the US is to really make a carbon-free “green” energy push, it would make sense that nuclear power is in the discussion. The debate over energy will continue on and it hopefully won’t be as serious or depressing as the HBO Chernobyl series. In the mean time, we will continue to see growth from natural gas fired generation and renewable generation, but it may not be enough to accomplish the political goals of carbon-free emission reduction of 60% or more. Electricity markets will remain in flux and Choice! Energy Management will continue to monitor potential structural changes during this time of debate.

Confidential: Choice Energy Services Retail, LP.