by Matthew Mattingly & Will Nash

If you are in the energy industry, a term you hear on a daily basis is “shale revolution.” The shale revolution describes the the technological advancement in hydrocarbon (oil, natural gas, NGLs) drilling that allows drillers to remove hydrocarbons from shale rock in a cost effective manner. This new way of pulling natural gas and oil out of the ground has led to a fall in commodity prices that end-users are taking advantage of today. However, I am not here to discuss hydraulic fracturing or commodity prices in the United States. There are countless articles that are written everyday discussing that subject. However, what I am hear to talk about is the term “Revolution.” Call it a complaint or simply just a pet peeve, but the shale “revolution” sounds a bit too dramatic. The Colonial States breaking away from Britain was a revolution. The French overthrowing their monarchy was a revolution. An alternative way to drill for oil and natural gas doesn’t seem to fit the revolution profile.

I am likely in the minority in this thinking, because the term “shale revolution” has become industry standard. Not only is the term used in industry articles and websites, but it is also the title of several books…

- The Green and the Black: The Complete Story of the Shale Revolution, the Fight over Fracking, and the Future of Energy By: Gary Sernovitz

- The Shale Energy Revolution: A Lawyer’s Guide By: America Bas Association

- After the US Shale Gas Revolution By: Thierry Bros

- Meet the New Frackers: A Landowner’s Guide for Successfully Navigating the Ever-Changing Shale Revolution (Volume 2) By: Thomas R Clay

- The Shale Gas Revolution By: Vincent J Lentini

- Shale Revolution0: How North America’s shale gas and tight oil plays are recalibrating to a more competitive environment By: Tom Haywood and Rachael Seely

However, when I google the definition of revolution (see below), it doesn’t seem hydrocarbon drilling fits the bill. The definition below uses examples of the American Revolution or Marxism that led to triumph of Communism to describe a revolution. These were dramatic changes that people lost their lives for, to overthrow a government or a way of thinking. These events altered history and still change the way society lives today, not just for that period of time. Not sue the same can be said for an alternative way to drill for oil and natural gas. Granted, the last definition example listed below does describe a marketing revolution as dramatic wide-reaching change; it seems out of place compared to the first two examples.

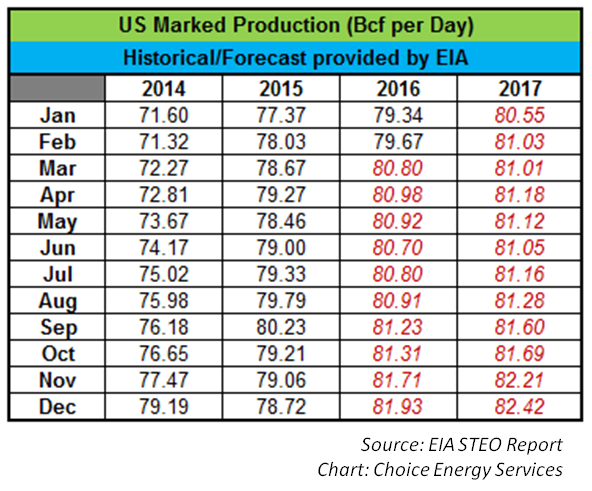

A better way to describe the transformation in drilling process is “Golden Era of Energy Commodities.” A period of time where the United States has benefited from ample supply due to hydraulic fracturing. This is especially true for natural gas. A commodity that went from shortfalls a decade ago to plentiful supplies in 2010 that still continues today. The excess supply of natural gas has led to collapse in natural gas prices, growth in new natural gas generation (replacing coal generation), new pipeline take-away capacity, increasing natural gas exports to Mexico, and LNG exportation to Asia and South America. Natural gas is the “hot” commodity in energy industry, but this hot commodity will only be a bridge to other alternative or green energy sources that is needed for the future. Thus, this time can only be considered a golden era for natural gas and other hydrocarbon fuels. Ample supplies will be here for now, but they will not impact our country forever.

Therefore going forward, let us all try to use the proper term to describe the transformation in the commodity drilling process. Remember it is not a revolution, but a golden era where end-users are benefiting from plentiful supply at reduced prices.

Off Topic

This blog entry discusses the “shale revolution” but the phrase always makes me think about the “industrial revolution.” The industrial revolution was beautifully described by Adam Sandler in the movie Billy Madison (jeopardy scene). Billy’s definition of the industrial revolution is shown below, but I changed the word “industrial” out for “shale,” amazingly the description has about the same effectiveness for either topic.

Billy Madison 1995

“OK. The (Shale) Revolution to me is just like a story I know called ‘The Puppy Who Lost His Way’. The world was changing and the puppy was getting bigger….so you see the puppy was like (Shale) in that they were both lost in the woods. And nobody, especially the little boy (society), knew where to find him. Except that the ‘Puppy’ was a dog. But the (shale) , my friend.. that was a revolution.”