by Matthew Mattingly

The best thing about Trump being president has to be political arguments. Not for me personally, but just watching others get in heated “discussions” because so many people love him or just flat out hate him no matter what he does. What is even more fun is starting political arguments. Nothing beats dropping a grenade of words, such as: Trump/Russia, Trump/Muslims, or Trump/Wire tapping and then just walking away to look back at the carnage. However, it seems the most controversial topic of the Trump presidency seems to be Trump/Mexico. There are just so many layers to peel back when discussing that topic, including: immigration, NAFTA, border wall, or how to even pay for the wall. Although these are great “discussion” points, as an energy analyst, I closely monitor the relationship between the United States and Mexico for other reasons. Natural gas exports to Mexico directly affect the U.S. supply/demand equilibrium and any changes would have a major impact on local supply and price.

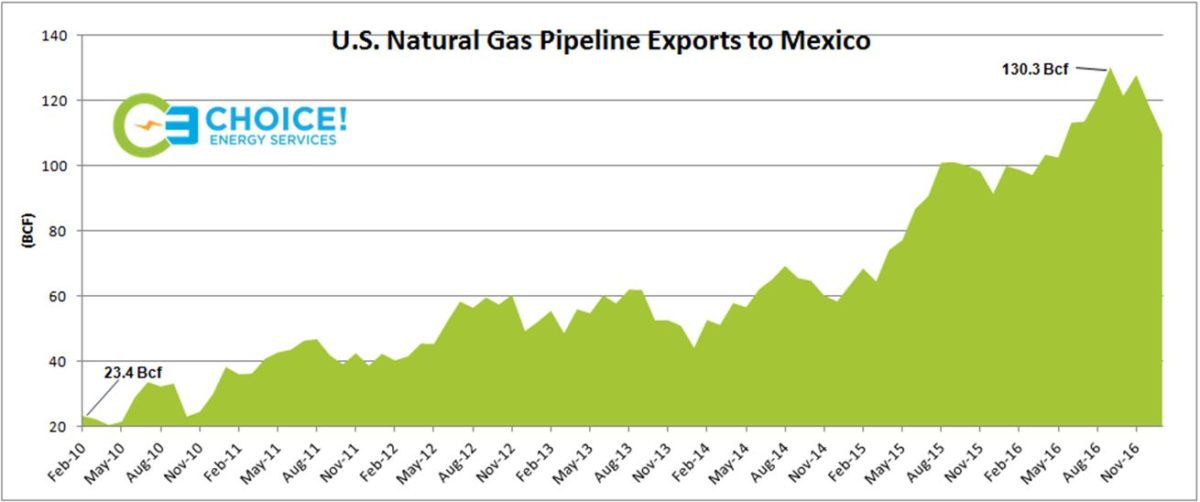

U.S. natural gas exports to Mexico have risen dramatically in recent years, representing a 500% increase since 2010. This past August saw the largest month of U.S. exports, with 130.3 Bcf (4.2 Bcf/D) of gas being sent to our southern neighbor. There are several factors for the rise. For starters, Mexican’s own domestic production starting to decline, while their natural gas demand has risen sharply. The increase demand is being fueled by the growth in the power and industrial sectors. The growth in the power sector is due to fuel switching. Mexico has traditionally been dependent on petroleum generation, but now natural gas represents over 50% of the generation load. The growth in Mexican natural gas generation will only continue as the country is slated to bring on 15,300 MW capacity from 2017-2020.

As discussed in Choice’s Bulls & Bears Reports, the growth of Mexican’s natural gas generation will likely be met by additional U.S. natural gas. Several pipeline projects are scheduled to come online in the coming years to bring cheap, shale gas from Texas into Mexico. The pipeline expansion started with the Los Ramones II that was completed in summer 2016, and brought an additional 1.1 Bcf/Day capacity into Mexico. Other projects to watch in the coming years is the Nueva Era Pipeline ( 1.12 Bcf/Day) , Comanche Trail (1.1 Bcf/Day), and Trans-Pecos Pipeline (1.35 Bcf/Day).

However, what effect will President Trump have on U.S. natural gas exports to Mexico? The relationship between the country’s two leaders are not off to best of starts, especially in regards to the proposed border wall. Trump insisted throughout his campaign that Mexico would pay for the wall; while Mexico has a different opinion. Additionally, the Trump administration has proposed a border tax on Mexico as they dispute fair trade between the two countries. Nevertheless, the one item that you don’t hear much about is natural gas. That’s because both sides benefit too much from the current arrangement. Clearly Mexico needs U.S. natural gas exports as the country is dealing with both supply shortages and demand spikes. However, U.S. producers has also benefited as the deliveries into Mexico have helped reduced the supply glut in the United States.

Natural gas production is expected to grow significantly in the coming years. The EIA is forecasting marked production to grow by 10 Bcf/D and reach 86.14 Bcf/D by the end of 2018. Thus, in the words of great Billy Madison “it takes more than two to tango” as the United States will need to continue exports to Mexico to ensure another price collapse doesn’t happen as did in 2016. Vise versa, Mexico will still be dependent on U.S. natural gas for their ever growing demand. At the end of the day, there will not be an impact on U.S. natural gas exports to Mexico anytime soon.

Source: EIA, U.S. Natural Gas Pipeline Exports to Mexico

Graph: Choice Energy Services

Confidential: Choice Energy Services Retail, LP.