Many analysts in the energy industry try to make a living by attempting to forecast the next big macro shift in oil prices. The truth of the matter is that nobody can fully anticipate movements in oil prices, not in this geopolitical environment, not with Trump as our President. Just when an analyst thinks they have completed the puzzle, the global market influences scramble and add in more pieces. OPEC decisions, sanctions on Iran, and Permian oilfield growth are a few topics worth discussing for current events but even these influencers change daily. If you need more proof as to the fallibility of a predictive analyst, just know that we are coming up on the 10th anniversary of the “Peak Oil” scare. Many analysts predicted that by 2018 global oil production would be drastically cut to 50 million barrels/day, but instead we have increased global production by nearly 15% to 100 million barrels/day. So where is oil going next, and how will energy prices be affected!? We won’t guess, but today we will start a multi-part blog series, briefly introducing the topics that keep oil market analysts on their toes.

Iran Deal Termination:

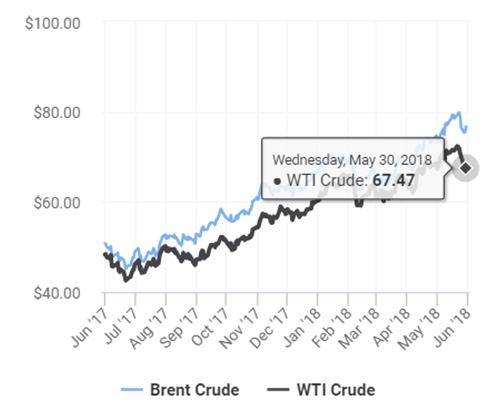

On May 8th President Trump announced that the US would be ending its’ involvement in the Iran deal, and reinstating the “heaviest” of economic sanctions on the nation. These sanctions will impact nearly every industry in Iran and will hit in August 2018. Since the Iran deal began in 2016, Iran has been able to increase their oil production from 2.9 to 3.8 million barrels per day (EIA). Almost half of this production growth is now expected to be lost. As a result of the news, WTI Crude prices pushed over the $70 mark.

OPEC Production Re-evaluation:

Since December 2017, OPEC has succeeded in lowering their collective production output. Consensus was that OPEC was re-balancing the market to reach a desired $70/bbl price. With the news on Iran, mixed with continued collapse in Venezuelan production, we are likely to see a shift in policy. This expectation has likely allowed Oil prices to come back down off their recent highs. OPEC cannot risk losing market share to growing American producers and this will likely put a lid on prices in the short run.

American Production Growth:

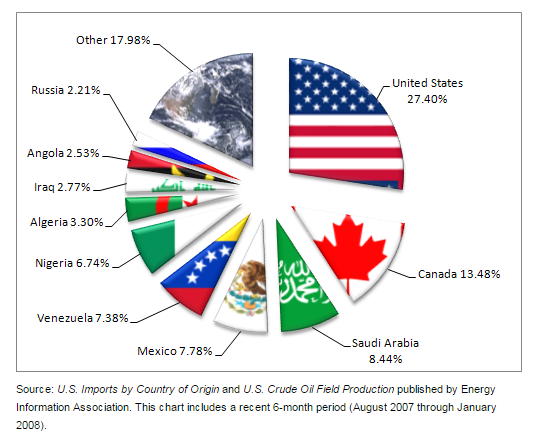

We have seen huge growth from American oil producers in the last several months. The increasing price of oil is likely the cause, and confirms the market share fears that OPEC has with American fracking producers. We have seen the EIA’s estimates for 2018 production climb to 10.722 MMb/d,a 1.37 MMb/d increase over 2017. The projections for 2019 are even more impressive at 11.58 MMb/d. It is important to note that these are only projections and are certainly susceptible to a different puzzle of micro/macro influences, such as pipeline constraints from the Permian basin. If forecasts are proven true, this production growth should help offset any bullish news that arises from other influencers.

After touching on a few of these current events, you can see the complexity in the oil market puzzle. It is all too easy to remain on the fence when trying to decipher the outcome in commodity markets. Luckily, retroactively criticizing the bold “Peak Oil” predictors is only what we do for fun at Choice Energy Services! Our analysts often write about and discuss where they believe oil, natural gas and electricity market prices are heading. These opinions are based in facts and data that can be seen in our market intelligence reports. Whether you are looking for detailed analysis like the Bulls and Bears report, or whether you simply enjoy mediocre, political cartoon-oriented blog pieces, Choice Energy Services has you covered on the latest oil market fundamentals. Check back soon for the next news worthy installment of our Oil market blog series.