“There’s no earthly way of knowing.. which direction we are going.. there’s no knowing where we’re rowing.. or which way the river’s flowing”

Oh how fast everything can change in our new modern world! A month ago we were innocently dissecting theoretical outcomes of political energy agendas, and now we are quarantined in our homes listening to others debate whether “the economic cure is worse than the disease”. We digress back to the energy markets, and back to the early 70’s when Gene Wilder in Willy Wonka and the Chocolate Factory was entertaining those going through the first OPEC oil price shock. You cannot help but laugh when watching the famous “Tunnel of Terror” scene thinking in context of what has occurred in 2020 so far. Energy markets have experienced a supply shock from OPEC, a demand shock from COVID-19, a wealth shock in the stock market, AND a credit shock from bank lending, all in a matter of 4 weeks. The fact is that any one of these shocks is capable of sending a well-informed business into chaos, but all 4 together is ludicrous. So before you throw your hands in the air and irrationally exit the psychedelic, tunnel-of-terror riverboat, lets dissect this situation, and ride this crazy boat to the golden geese on the other side.

WTI Crude

- Down 63% since 2/20/20 to $20.

- OPEC, Russia and US producers all continue maximal oil production, even as oil demand has dropped an estimated 20% year over year due to COVID-19.

- Diplomatic and pandemic news will be the only short-term catalyst for this market. Watch for the US to first make a diplomatic and then a potentially stronger economic approach with Saudi Arabia, as many lawmakers have already accused them of “Economic warfare”.

Economy

- Dow Jones down 25% since 2/20/20 to 22,000.

- Congress has approved a stimulus package and this will look to curb economic uncertainty fears.

- The Federal Reserve has taken unprecedented action to ensure credit doesn’t tighten, even as board members predict “scary” outcomes of 30% unemployment.

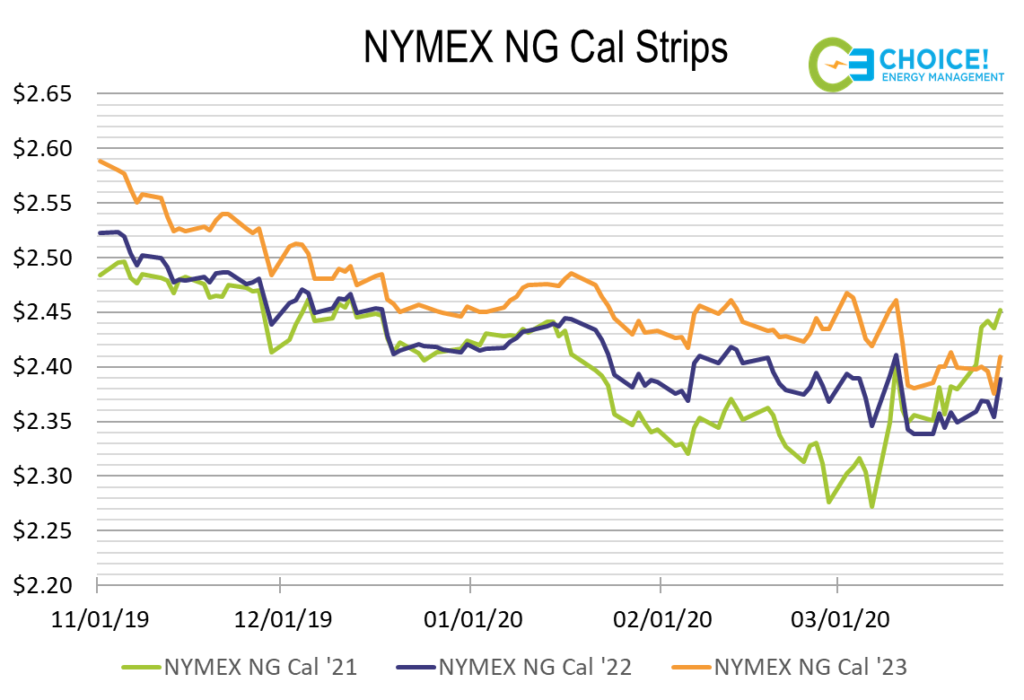

NYMEX Natural Gas

- NYMEX Prompt down 15% to inflation adjusted all time low of $1.634.

- The May contract could fall further if we see a decrease in quarantine-driven commercial demand and continued below average weather-driven demand.

- The calendar ’21 strip price has risen 15 cents off the bottom, potentially due to decreased production outlooks.

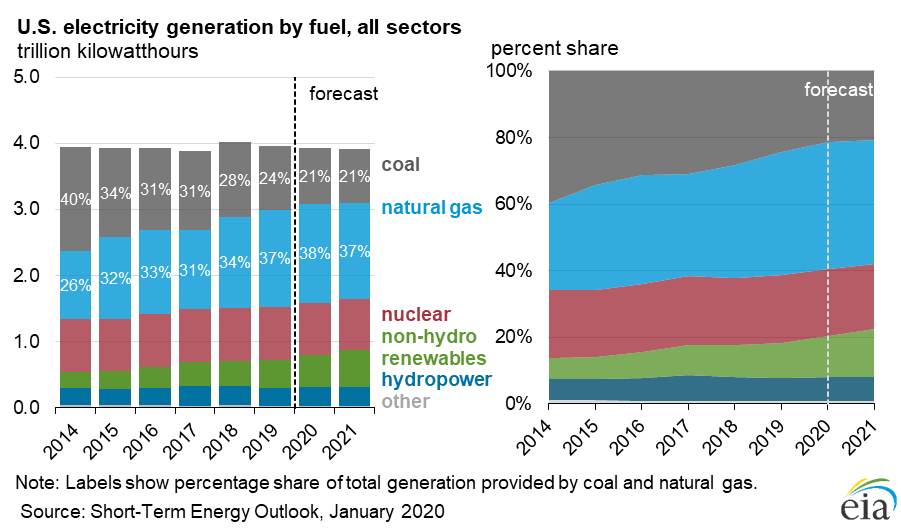

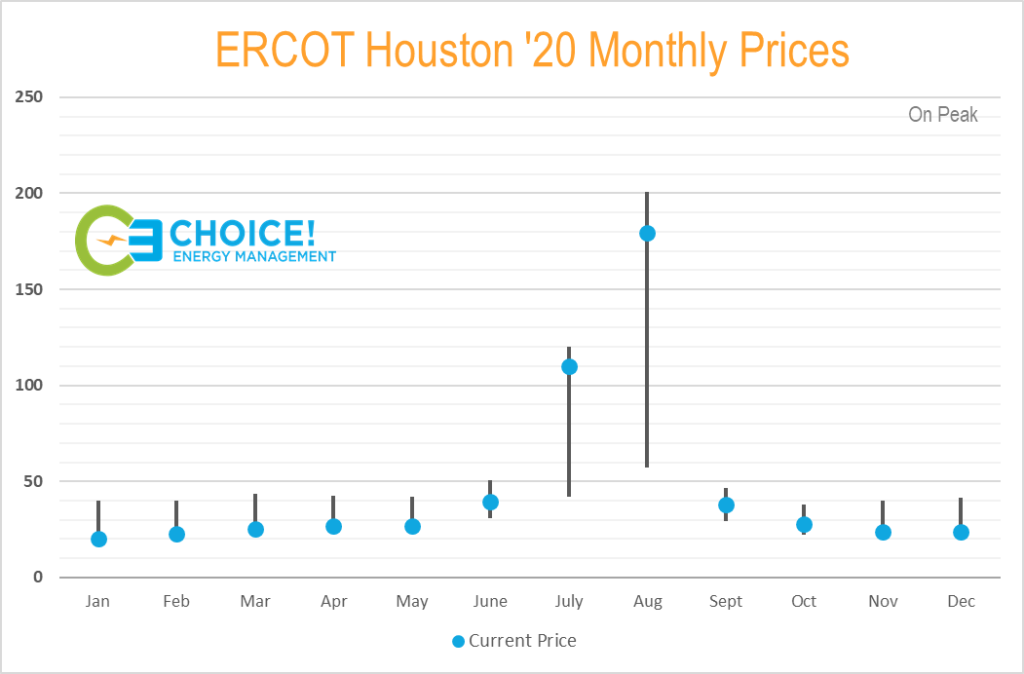

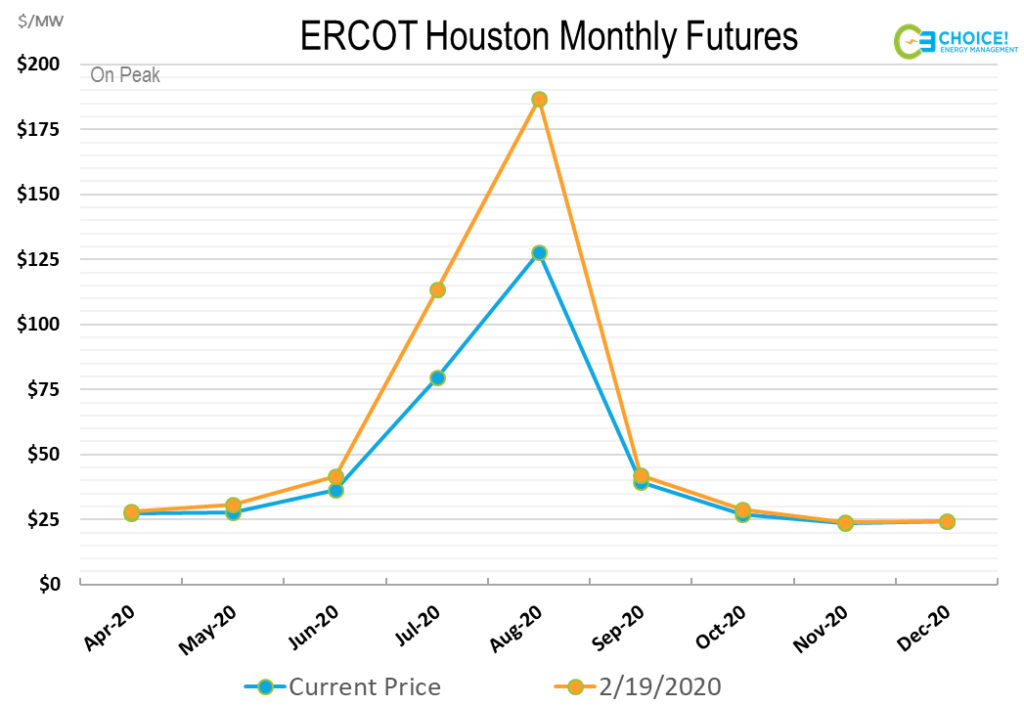

Power Prices

- Summer 2020 ISO Power Prices are down 20-30% nationwide.

- New York is reporting power demand 5% below 2019 weather-adjusted levels.

- ERCOT has seen no clear impacts to demand at this time but the ’20 summer strip in Texas is coming down from all-time highs.

Energy Sector Health

- The Dallas Federal Reserve energy sector vitality survey hit its lowest score recorded in its 4-year history.

- Optimism is low from energy producers at current price levels.

- If the current situation persists longer than 4-6 months, we could see producers go bankrupt. This disruption would send current supply levels lower for Oil and Natural Gas.

Policy Update

- As of last declaration from President Trump, COVID-19 containment protocol is recommended to stay in place through April 30, meaning demand destruction and general uncertainty could continue for another month.

If Choice! Energy Management had floated the idea of all of these events occurring simultaneously two months ago, we would have been branded crazier than the idea of a magic chocolate factory. There is no historical event to compare this situation to and the energy markets were already in uncharted waters. For this reason, it could be an opportunistic time for businesses with the means to capitalize on future market positions. A black swan type event, like what we have seen this past month, reinforces the idea of needing a sound energy risk management action plan in place for a business. The gamble is too large. While current events have depressed commodity prices (generally good for businesses), it is no longer impossible to imagine a scenario where prices rise and cost businesses billions in unprotected energy costs. Balancing a businesses risk tolerance with sound fundamental and technical knowledge of energy markets should be the golden goose your business seeks to attain. At Choice! Energy Management we pride ourselves on leading our clients through all energy landscapes (no matter how ominous). Please feel free to reach out for energy help during these trying times, and above all else, look out for each other on this crazy river boat ride we call life.

Confidential: Choice Energy Services Retail, LP.