Puppet Master: (Noun) “A person, group, or country that covertly controls another”

The weird thing about having such an unreserved President in office has been the rather predictable, unpredictability. One day we hear about alleged affairs with porn stars, but we know it will quickly be forgotten the next day when North Korea pledges to denuclearize. News cycles today run 24/7 and “politics aside” (like honestly; not the cliché use of the term that your uncle uses before he’s about to go on a highly opinionated Facebook rant), everyone can admit that President Trump has been “pulling the strings” of conversations on a domestic and global level. One of the most heavily covered topics of 2018 so far has been President Trump’s aims at shaking up the global landscape for trade. In the State of the Union address, President Trump stated that, “We have ended the war on American energy”, but certain policies and actions could cripple American energy growth domestically and globally. We recently covered this topic more in depth in our last Bulls and Bears Report, and today we will continue to critique Trump’s predictably, unpredictable puppet show and how it could affect domestic energy consumers.

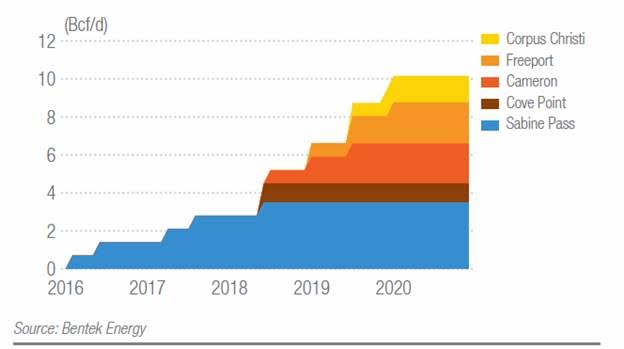

In early March, the Trump Administration placed a tariff on imported steel and aluminum from certain countries. Placing tariffs on the individual puppet items from foreign countries may seem like a patriotic thing to do (reference a truly America-first politician here), but in reality the physical ramifications could end up hurting American energy consumers. Domestically, the 25% tariff placed on steel has huge implications for nearly every stage of the energy industry’s processes. Producers will have to factor in higher costs for well construction, which begin the process of capturing the vast reserves of oil and gas that the US has. The specialty-order steel pipelines, that are currently only made in China, could cause serious delays or even cancellations of the pipelines the US is lacking. Also, we would almost certainly see a 5-10% increase in construction costs for heavily steel dependent LNG exportation facilities. These are but a few of the foreseeable domestic impacts that would come from a steel tariff, and Trump’s tariff would likely not end there.

Globally, the implications are harder to measure, but trade talks and deals serve as the stage in which Trump plays his show. You can boil global trade implications down to the fact that if American energy producers are “winning”, Americans are “winning”. The US is currently the top producing gas and oil country, and production growth estimates have risen by nearly 10% over the last year. This has given the US the potential to compete against OPEC and Russia for more market share on the global stage. The enormous potential for the US to supply gas and oil to countries like China and Mexico makes the current trade war talks especially troubling. Tensions have eased recently with China and we may soon see a NAFTA 2.0, but as we have discussed, the situation is still predictably unpredictable. Any deals that hinder American energy investment and growth in these markets would disincentivize domestic production.

So how could energy prices react to all of these happenings and potential situations? This answer is as complex as global trade itself. Domestically, the tariff increasing steel costs would mean that we could see higher costs to move gas, oil and electricity, and potentially higher prices. At the same time, higher LNG facility construction costs would discourage new export facilities, which would keep more gas stateside, in turn depressing natural gas and power prices in the short run. While this is just a small simplified picture of the complex domestic market movements, the implications would obviously be much clearer and more devastating if China or other countries placed a tariff on American energy. While the outcome of a trade war situation is not completely known, the analysts at Choice Energy Services will continue to monitor the situation to better help our clients hedge against potentially volatile price impacts. Cheers to 2.5 more years of predictable unpredictability.

Confidential: Choice Energy Services Retail, LP.