We have saved the broadest, yet most impactful, oil market discussion for part III of this blog series. The latest round of geopolitical news has made the oil market crystal ball less murky. The interactions between the countries of OPEC, Russia, China and the United States are tense, and oil prices are at the mercy of the discussions. The continued uncertainty and recent hypothetical outlooks add a strongly bullish argument for the price of oil, currently at $74/barrel (bbl) for WTI. Analysts are currently debating several fundamentals including; the physical capabilities of global spare production capacity, the politics of OPEC, implications of Iranian news and lastly, how negotiations from President Trump factor in. While oil market volatility never ceases, this blog will provide the current geopolitical condition and the impact on oil prices.

The Situation

We last discussed the how global influences can affect natural gas and oil in our blog “Trade Wars: Energy in the Marionette Theatre”. The global market for oil is no less complicated and the chronological story centers on a few main factors.

Loss of Production

With the implementation of sanctions on Iran and Venezuela, it is estimated that global oil production has already fallen by 1.5 million bbls/day and could fall by another 1 to 3 million bbls/day by the end of 2018. This figure is dependent upon the rate of collapse in Venezuela, as well as the strength of participation globally in the Iranian oil embargo. Add to this the fact that OPEC was collectively trying to cut production in the first half of 2018. OPEC has since ceased production cuts, with Saudi Arabia producing 500,000 bbls/day more in June than in May.

Spare Production Uncertainty

Over the past two weeks we have seen President Trump tweeting about the oil markets and discussing the potential for production increases. It is estimated that Saudi Arabia is the only country with significant spare capacity, with the potential for an additional 2 million bbls/day. Russia is rumored to have an additional 500,000 bbls/day in spare capacity and all the other countries producing oil could potentially add another 500,000 bbls/day. The caveat is that all of this spare capacity is speculative, due to the physical uncertainties of pumping oil from the ground.

Immeasurable Geopolitical Impacts

Price shocks rarely come from anticipated events, but there have been clues recently. President Trump is not the first US president to criticize OPEC, but he does seem to have leverage. Saudi Arabia is torn between their OPEC alliance and their new found alliance with the U.S. President and his ability to maintain the Iranian embargo. Saudi Arabia risks hurting OPEC cooperation in the long run by alienating Iran, for the sake of their financial benefit by appeasing the wishes of President Trump. Iran recognizes this situation and recently threatened a blockade of the Strait of Hormuz. This essential waterway would cut off 35% of the world’s oil (including Iran’s) and is a seen as a nuclear option for Iran (likely bringing armed confrontation) if all else fails.

Price Implications

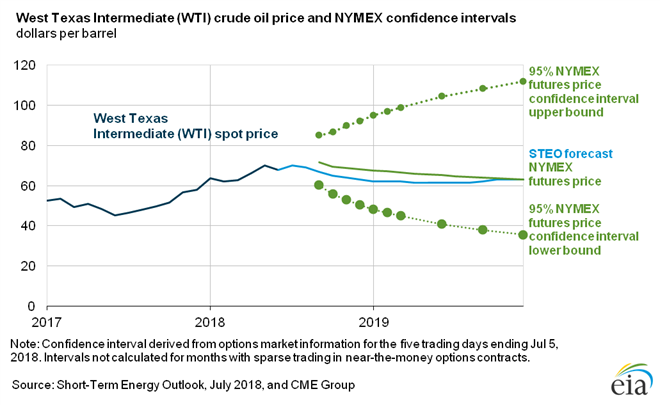

When discussing geopolitical influences on the price of oil, historically you haven’t needed a crystal ball to know that the risk has always been to the upside. While this is currently a safe bet, it is also grounded in the facts and figures of the current market situation. If we continue to see increasing oil demand from the US and China, mixed with un-replaced, lost production from Venezuela and Iran, then we will certainly see prices increase. Any news about lower spare production capacity from OPEC will also bring prices higher. The final and most volatile factor in the equation is that any news or potential for armed conflict in the Middle East will bring oil prices higher. All of this risk is likely the reason why the futures market confidence intervals favors upside movement.

Confidential: Choice Energy Services Retail, LP.